-

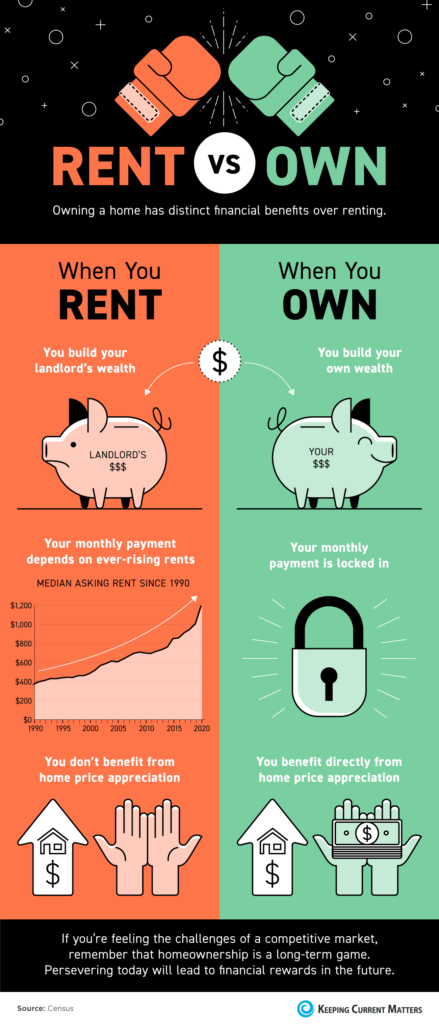

- When you rent, you build your landlord’s wealth, your monthly payment depends on ever-rising rents, and you don’t benefit from home price appreciation.

- On the other hand, when you own your home, you build your own wealth, your monthly payment is locked in, and you benefit directly from home price appreciation.

- If you’re feeling the challenges of a competitive market, remember that homeownership is a long-term game. Persevering today will lead to financial rewards in the future.

- Make sure to reach out to a real estate professional to assist you with your decision to buy or rent.

Tag Archives: rent vs own

Homeowners Net Worth is 40x Greater Than A Renters Net Worth

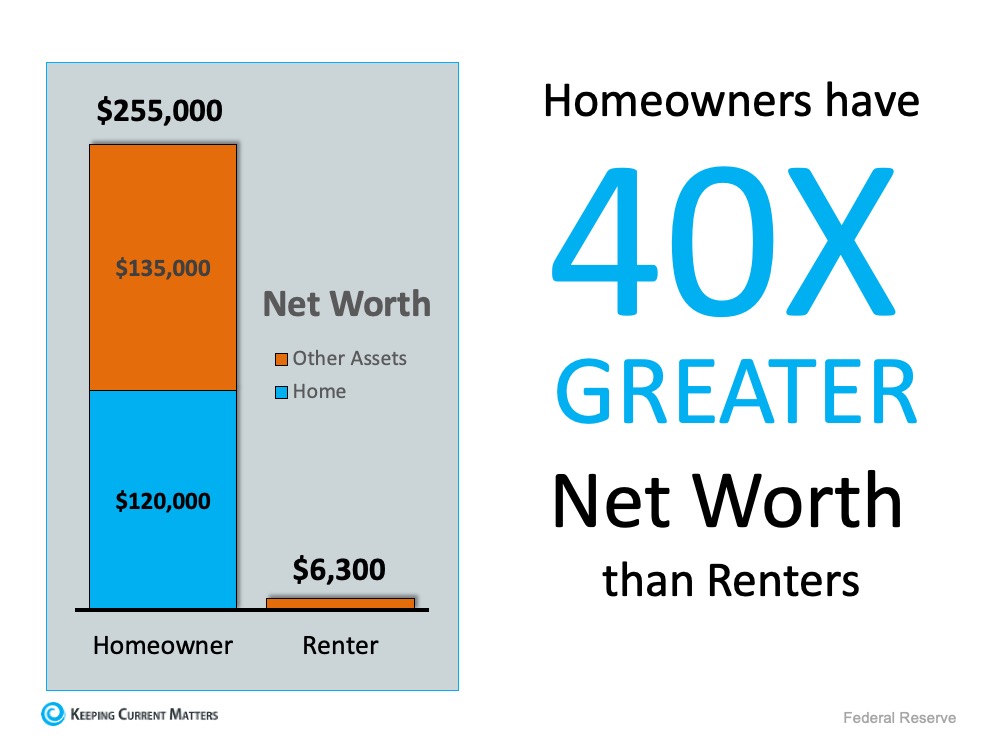

One of the best ways to build your family’s financial future is through homeownership. Recent data from the Federal Reserve indicates the net worth of a homeowner is actually over 40 times greater than that of a renter. Maybe it’s time to start thinking about buying a home, especially when they’re so affordable in today’s market.

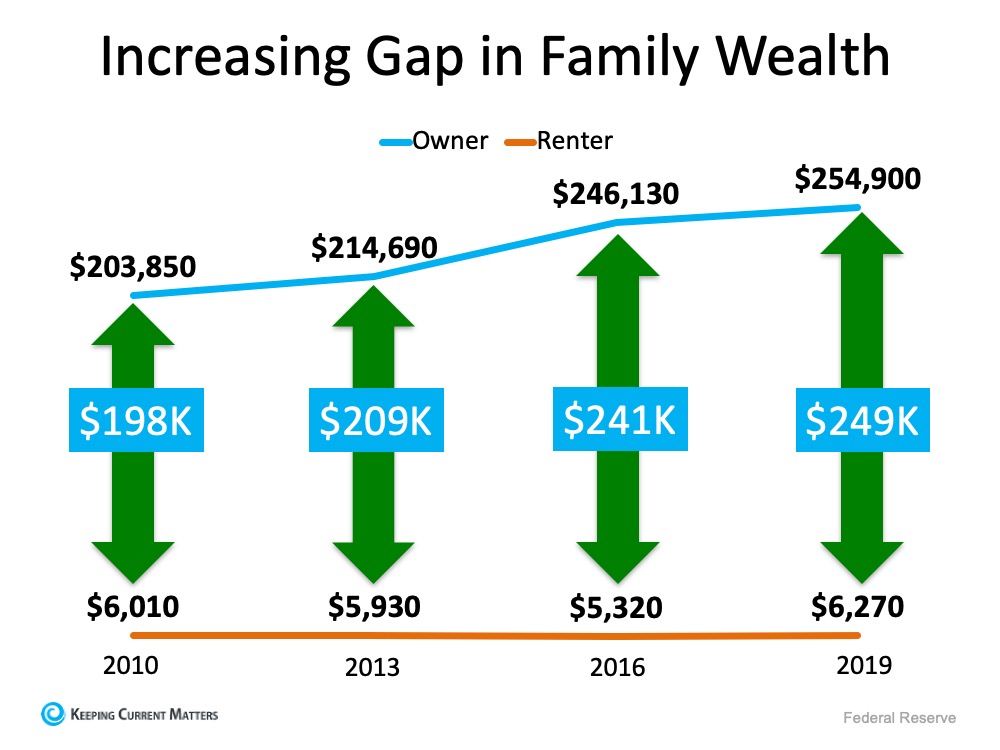

Every three years the Survey of Consumer Finances shows the breakdown of how owning a home helps build financial security. In the graph below, we see that the average net worth of homeowners continues to grow, while the net worth of renters tends to hold fairly steady and be significantly lower than that of homeowners. The gap between owning and renting just keeps getting wider over time, making homeownership more and more desirable for those who are ready.

Owning a home is a great way to build family wealth.

For many families, homeownership serves as a form of ‘forced savings.’ Every time you pay your mortgage, you’re contributing to your net worth by increasing the equity you have in your home (See chart below): The impact of home equity is part of why Gallup reports that Americans picked real estate as the best long-term investment for the seventh year in a row. According to this year’s survey, 35% of Americans chose real estate over stocks, savings accounts, gold, and bonds.

The impact of home equity is part of why Gallup reports that Americans picked real estate as the best long-term investment for the seventh year in a row. According to this year’s survey, 35% of Americans chose real estate over stocks, savings accounts, gold, and bonds.

Today, there are great opportunities available for those planning to buy a home. The housing market has made a full recovery, and all-time low interest rates are giving homebuyers a big boost in purchasing power. If you’re ready, buying a home this fall can set you up to increase your net worth and create a safety net for your family’s future.

Bottom Line

To learn how you can use your monthly housing cost to build your family’s net worth, reach out to a trusted real estate professional in your area who can guide you through the homebuying process.