Owning a home has great financial benefits.

In a recent research paper, Homeownership and the American Dream, Laurie S. Goodman and Christopher Mayer of the Urban Land Institute explained:

“Homeownership appears to help borrowers accumulate housing and nonhousing wealth in a variety of ways, with tax advantages, greater financial flexibility due to secured borrowing, built-in ‘default’ savings with mortgage amortization and nominally fixed payments, and the potential to lower home maintenance costs through sweat equity.”

Let’s breakdown 5 major financial benefits of homeownership:

1. Housing is typically the one leveraged investment available

Homeownership allows households to amplify any appreciation on the value of their homes by a leverage factor. A 20% down payment results in a leverage factor of five, meaning every percentage point rise in the value of your home is a 5% return on your equity. If you put down 10%, your leverage factor is 10.

Example: Let’s assume you purchased a $300,000 home and put down $60,000 (20%). If the house appreciates by $30,000, that is only a 10% increase in value but a 50% increase in equity.

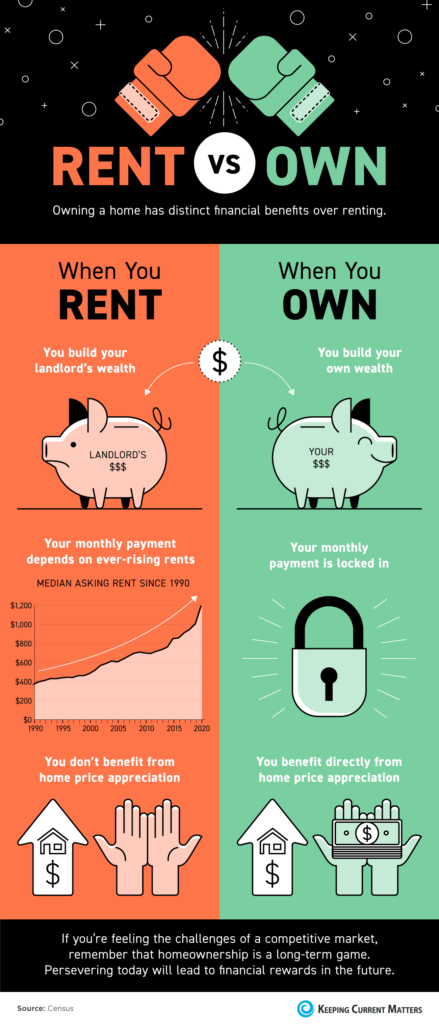

2. You’re paying for housing whether you own or rent

Some argue that renting eliminates the cost of property taxes and home repairs. Every potential renter must realize that all the expenses the landlord incurs (property taxes, repairs, insurance, etc.) are baked into the rent payment already – along with a profit margin!!

3. Owning is usually a form of “forced savings”

Studies have shown that homeowners have a net worth that is 44X greater than that of a renter. As a matter of fact, it was recently estimated that a family buying an average priced home this past January could build more than $42,000 in family wealth over the next five years.

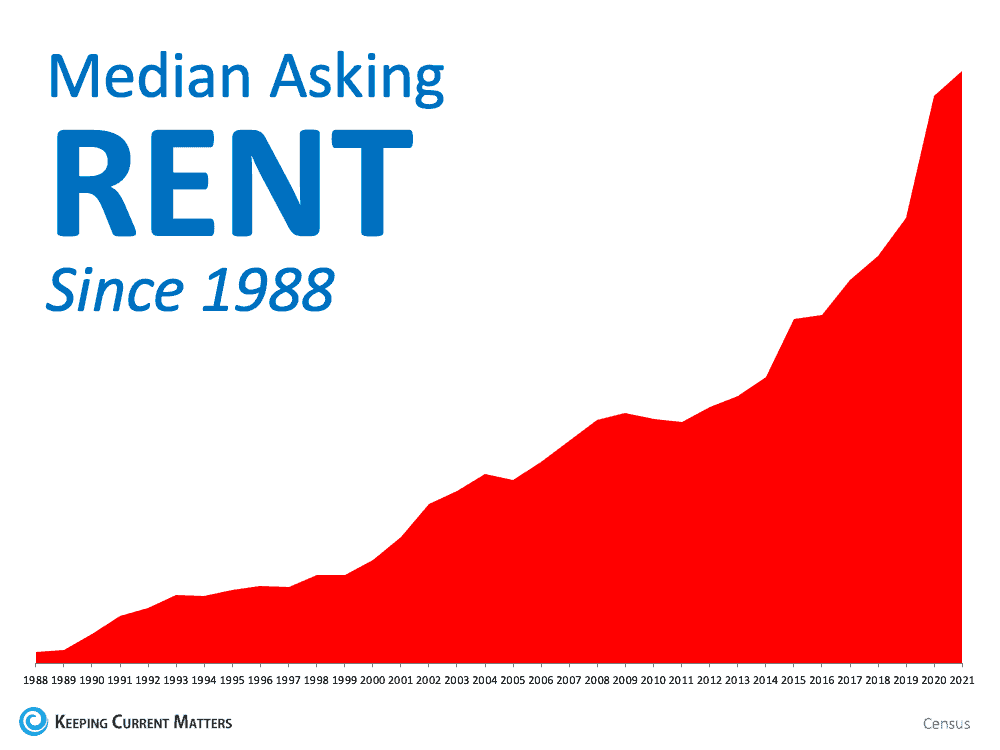

4. Owning is a hedge against inflation

House values and rents tend to go up at or higher than the rate of inflation. When you own, your home’s value will protect you from that inflation.

5. There are still substantial tax benefits to owning

We know that the new tax reform bill puts limits on some deductions on certain homes. However, in the research paper referenced above, the authors explain:

“…the mortgage interest deduction is not the main source of these gains; even if it were removed, homeowners would continue to benefit from a lack of taxation of imputed rent and capital gains.”

Bottom Line

From a financial standpoint, owning a home has always been and will always be better than renting.