While the housing market forecast for the second half of the year remains positive, there may not be a better time to sell than right now. Here are four things to consider if you’re trying to decide if now’s the right time to make a move.

1. Your House Will Likely Sell Quickly

According to the most recent Realtors Confidence Index released by the National Association of Realtors (NAR), homes continue to sell quickly. The report notes homes are selling in an average of just 17 days.

Average days on market is a strong indicator of buyer competition, and homes selling quickly is a great sign for sellers. It’s one of several factors that indicate buyers are motivated to do what it takes to purchase the home of their dreams.

2. Buyers Are Willing To Compete for Your House

In addition to selling fast, homes are receiving multiple offers. NAR reports sellers are seeing an average of 5 offers, and these offers are competitive ones. Shawn Telford, Chief Appraiser at CoreLogic, said in a recent interview:

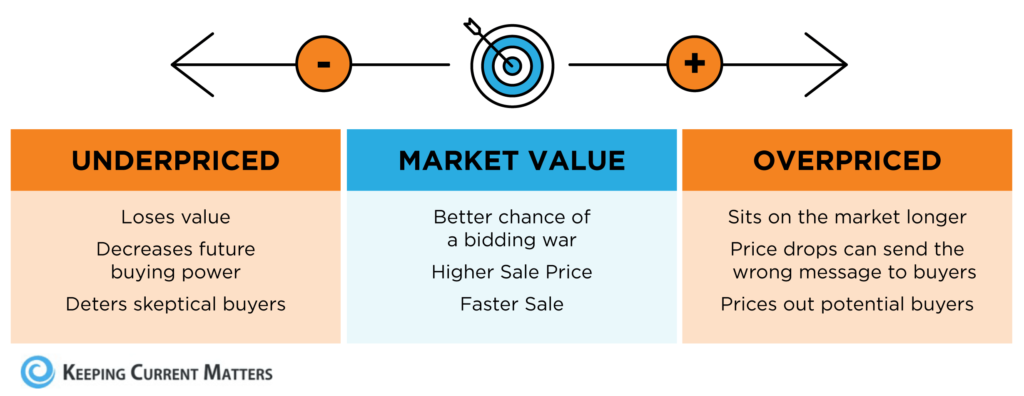

“The frequency of buyers being willing to pay more than the market data supports is increasing.”

This confirms buyers are ready and willing to enter bidding wars for your home. Receiving several offers on your house means you can select the one that makes the most sense for your situation and financial well-being.

3. When Supply Is Low, Your House Is in the Spotlight

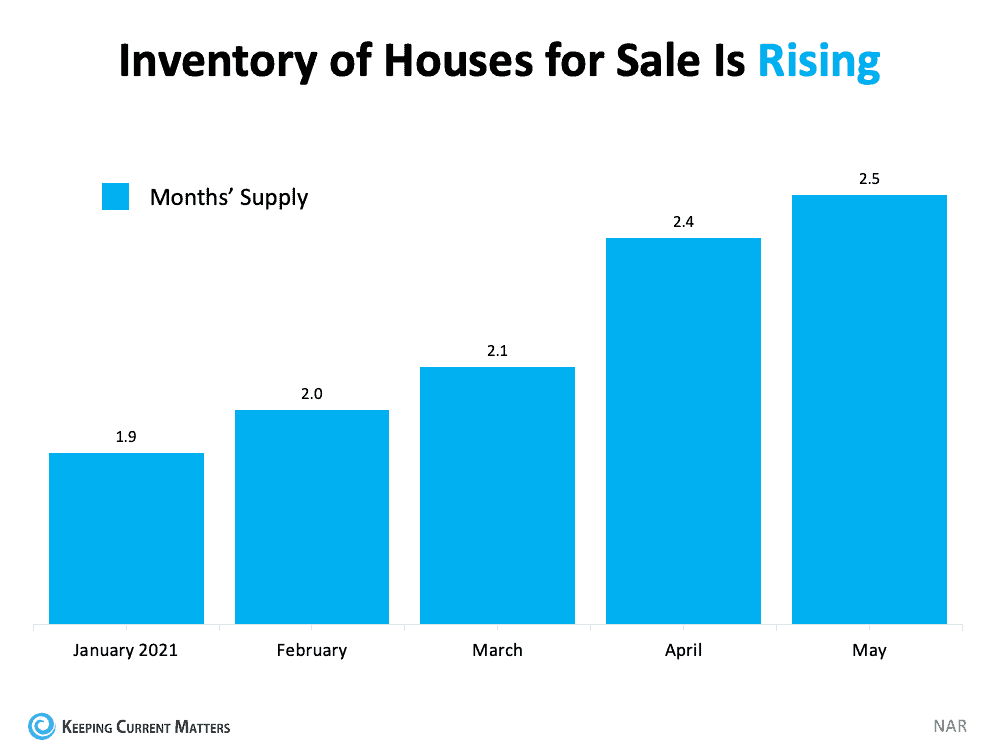

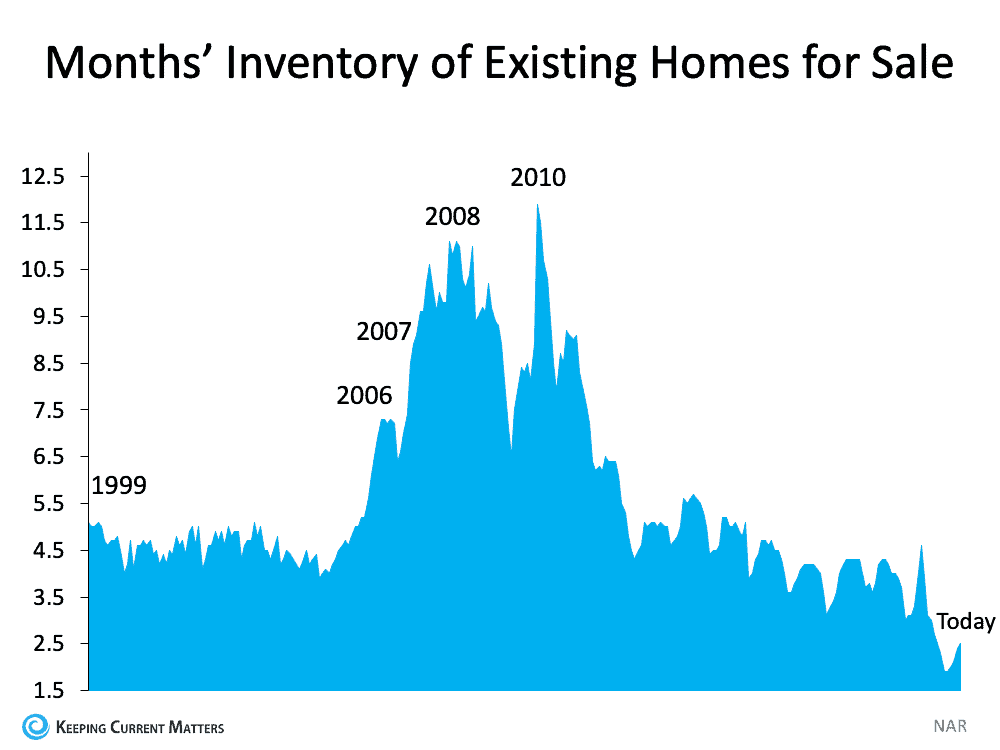

One of the most significant challenges for motivated buyers is the current inventory of homes for sale, which while improving, remains at near-record lows. As NAR details:

“Total housing inventory at the end of May amounted to 1.23 million units, up 7.0% from April’s inventory and down 20.6% from one year ago (1.55 million). Unsold inventory sits at a 2.5-month supply at the present sales pace, marginally up from April’s 2.4-month supply but down from 4.6-months in May 2020.”

There are signs, however, that more homes are coming to market. Odeta Kushi, Deputy Chief Economist at First American, notes:

“It looks like existing inventory is starting to inch up, which is good news for a housing market parched for more supply.”

If you’re looking to take advantage of buyer demand and get the most attention for your house, selling now before more listings come to the market might be your best option.

4. If You’re Thinking of Moving Up, Now May Be the Time

Over the past 12 months, homeowners have gained a significant amount of wealth through growing equity. In that same period, homeowners have also spent a considerable amount of time in their homes, and many have decided their house doesn’t meet their needs.

If you’re not happy with your current home, you can leverage that equity to power your move now. Your equity, plus current low mortgage rates, can help you maximize your purchasing power.

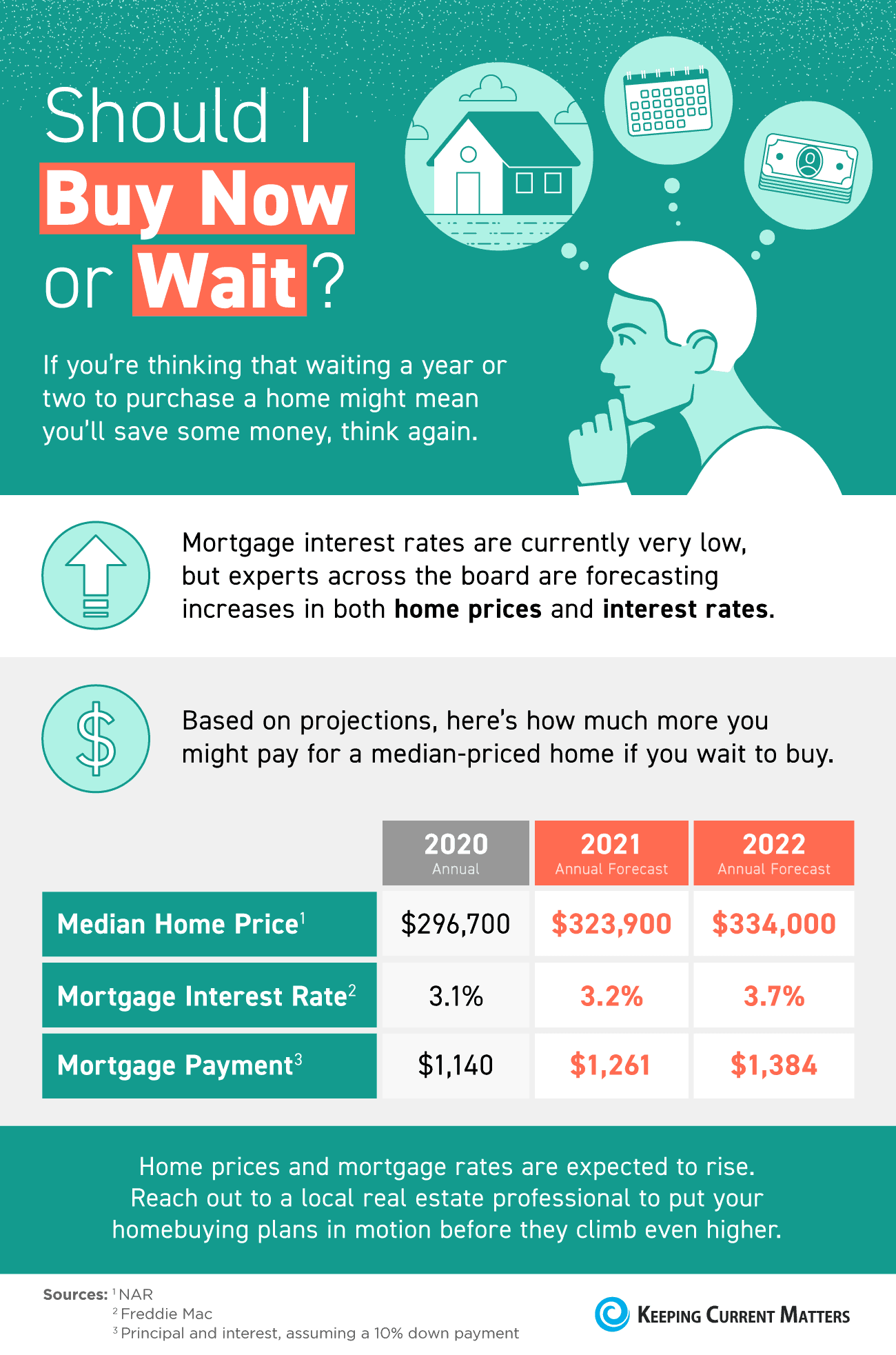

But these near-historic low rates won’t last forever. Experts forecast interest rates will increase in the coming months. Nadia Evangelou, Senior Economist and Director of Forecasting at NAR, says:

“Nevertheless, as the economic outlook for the United States looks brighter for the rest of the year, mortgage rates are expected to rise in the following months.”

As interest rates rise, even modestly, it could influence buyer demand and your purchasing power. If you’ve been waiting for the best time to sell to fuel your move up, you likely won’t find more favorable conditions than those we’re seeing today.

Bottom Line

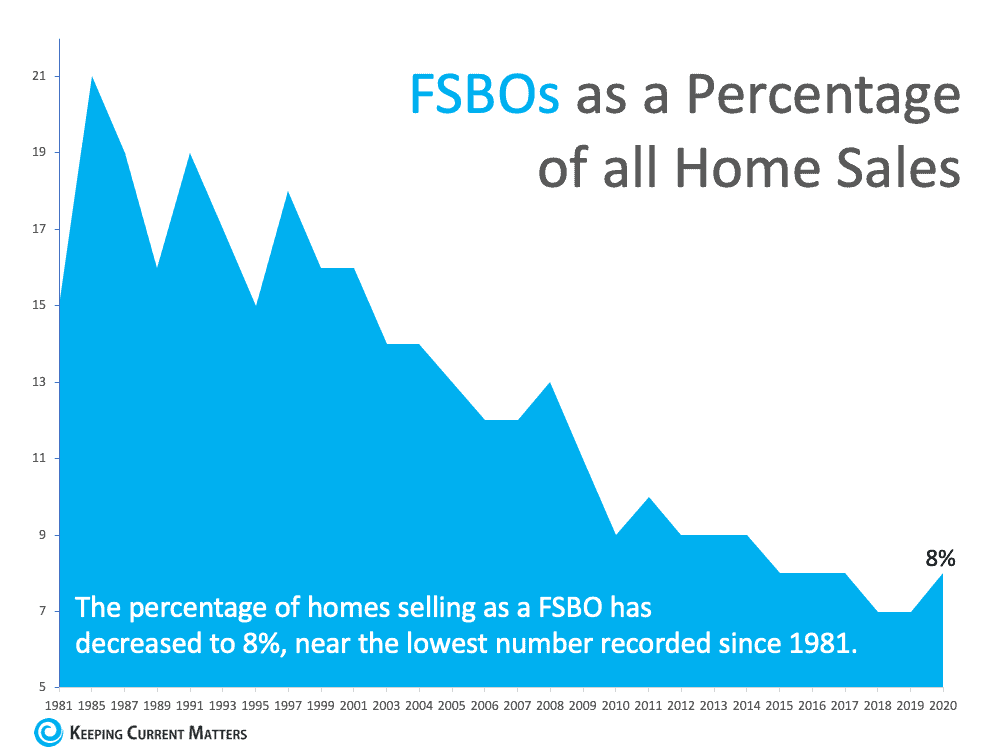

With supply challenges, low mortgage rates, and extremely motivated buyers, sellers are well-positioned to take advantage of current market conditions right now.

If you’re thinking about selling, talk to your trusted real estate advisor today about why it makes sense to list your house sooner than later

source