If you’re searching for a home online, you’re not alone; lots of people are doing it. The question is, are you using all of your available resources, and are you using them wisely? Here’s why the Internet is a great place to start the home-buying process, and the truth on why it should never be your only go-to resource when it comes to making such an important decision.

According to the National Association of Realtors (NAR), the three most popular information sources home buyers use in the home search are:

- Online website (93%)

- Real estate agent (86%)

- Mobile/tablet website or app (73%)

Clearly, you’re not alone if you’re starting your search online; 93% of home buyers are right there with you. The even better news: 86% of buyers are also getting their information from a real estate agent at the same time.

Here are 3 top reasons why using a real estate professional in addition to a digital search is key:

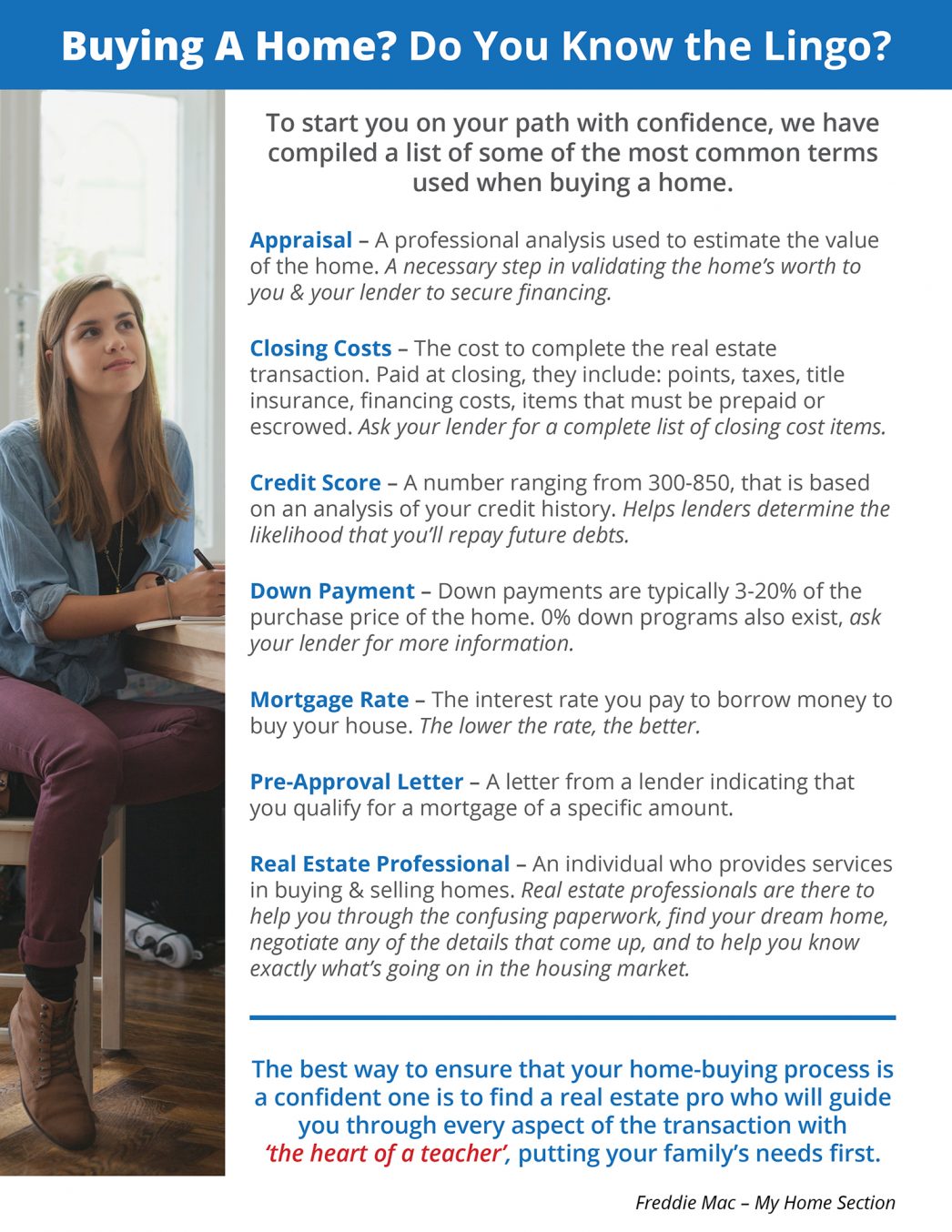

1. There’s More to Real Estate Than Finding a Home Online. It’s a lonely and complicated trek around the web if you don’t have a real estate professional to also help you through the 230 possible steps you’ll face as you navigate through a real estate transaction. That’s a pretty staggering number! Determining your price, submitting an offer, and successful negotiation are just a few of these key steps in the sequence. You’ll definitely want someone who has been there before to help you through it.

2. You Need a Skilled Negotiator. In today’s market, hiring a talented negotiator could save you thousands, maybe even tens of thousands of dollars. From the original offer to the appraisal and the inspection, many of the intricate steps can get complicated and confusing. You need someone who can keep the deal together until it closes.

3. It Is Crucial to Make a Competitive and Compelling Offer. There is so much information out there in the news and on the Internet about home sales, prices, and mortgage rates. How do you know what’s specifically going on in your area? How do you know what to offer on your dream home without paying too much or offending the seller with a lowball offer?

Dave Ramsey, the financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Hiring a real estate professional who has his or her finger on the pulse of the market will make your buying experience an informed and educated one. You need someone who is going to tell you the truth, not just what they think you want to hear.

Bottom Line

If you’re ready to start your search online, don’t skip over the support of an educated and informed real estate professional. You’ll want someone at your side who can answer your questions and guide you through a process that can be complex and confusing if you go at it with the Internet alone.

source