If you’re following along with the news today, you’re probably hearing a lot about record-breaking home prices, rising consumer costs, supply chain constraints, and more. And if you’re thinking about purchasing a home this year, all of these inflationary concerns are likely making you wonder if you should wait to buy. Investopedia explains that during a period of high inflation, prices rise across the board. And while home prices aren’t immune from this increase, here’s why inflation shouldn’t stop you from buying a home in 2022.

Homeownership Offers Stability and Security

Home prices have been increasing for quite some time, and experts say they’re going to continue to climb throughout 2022. So, as a buyer, how can you protect yourself from rising costs for things like food, shelter, entertainment, and other goods and services? The answer lies in housing.

Buying a home allows you to lock in your monthly mortgage payment for the foreseeable future. That means as other prices rise, your monthly payment will be consistent thanks to your fixed-rate mortgage. This gives you the peace of mind that the bulk of your housing costs is shielded from inflation.

James Royal, Senior Wealth Management Reporter at Bankrate, says:

“A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. Sure, property taxes will rise and other expenses may creep up, but your monthly housing payment remains the same.”

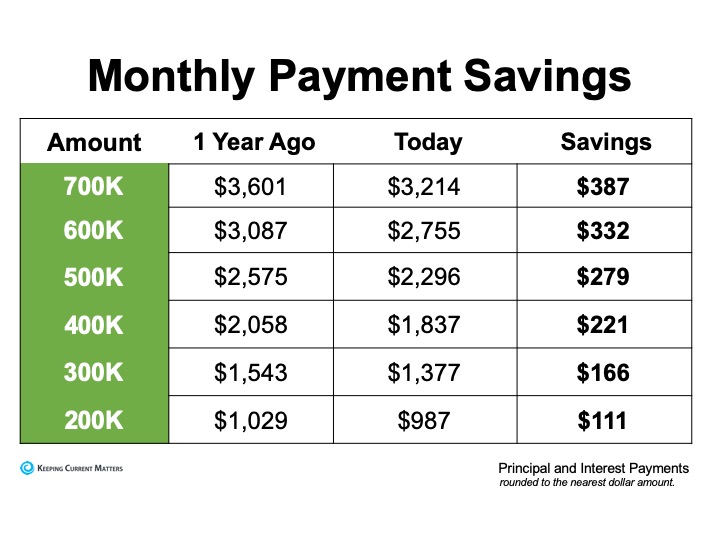

If you rent, you don’t have that same benefit and you won’t be protected from rising housing costs. As an added incentive to buy, consider that today’s mortgage interest rates are lower than they have been in decades. While inflation decreases what your dollars can buy, low mortgage rates help counteract it by boosting your purchasing power so you can get more home for your money. They also help keep your monthly payments down. This is especially important during an inflationary period because you’ll want to protect yourself from the impact of inflation as much as possible.

Ali Wolf, Chief Economist at Zonda, explains:

“If you have cash and are expecting inflation, you want to think through where you can put your money so it does not lose value. Housing is commonly looked at as a good inflation hedge, especially with interest rates so low.”

Bottom Line

The best hedge against inflation is a fixed housing cost.

That’s why you shouldn’t let it stop you from buying a home this year.

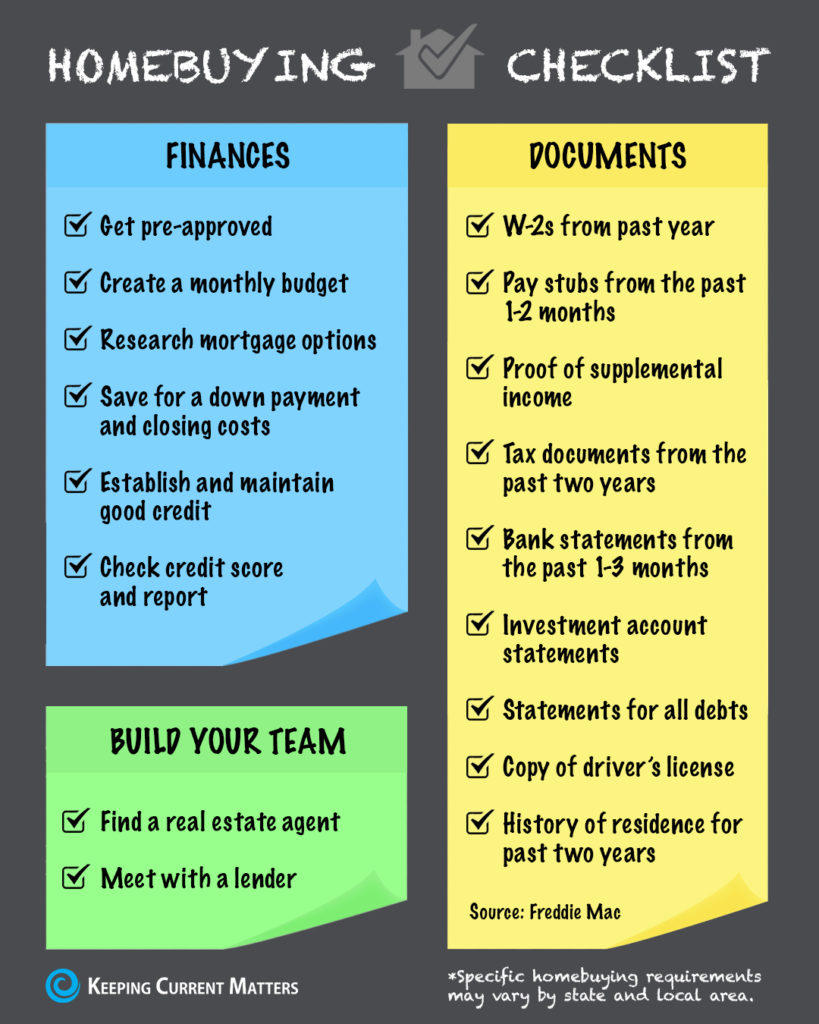

Not sure where to start?

Connect with a real estate professional so you have expert advice and help throughout every step of the homebuying process.