There’s an influx of buyers looking for homes today, and that means your house is in high demand. Here are a few reasons why so many people are looking to buy a home.

Buyers are motivated to beat rising mortgage rates, and many want to escape rising rents. There’s also additional demand from millennials who are reaching peak homebuying age.

If you’re thinking about selling your house, today’s demand is great news. Reach out to a local real estate professional to begin the process of listing your house while buyers are ready to purchase.

Tag Archives: tara burner real estate

Are You Ready To Fall In Love With Homeownership

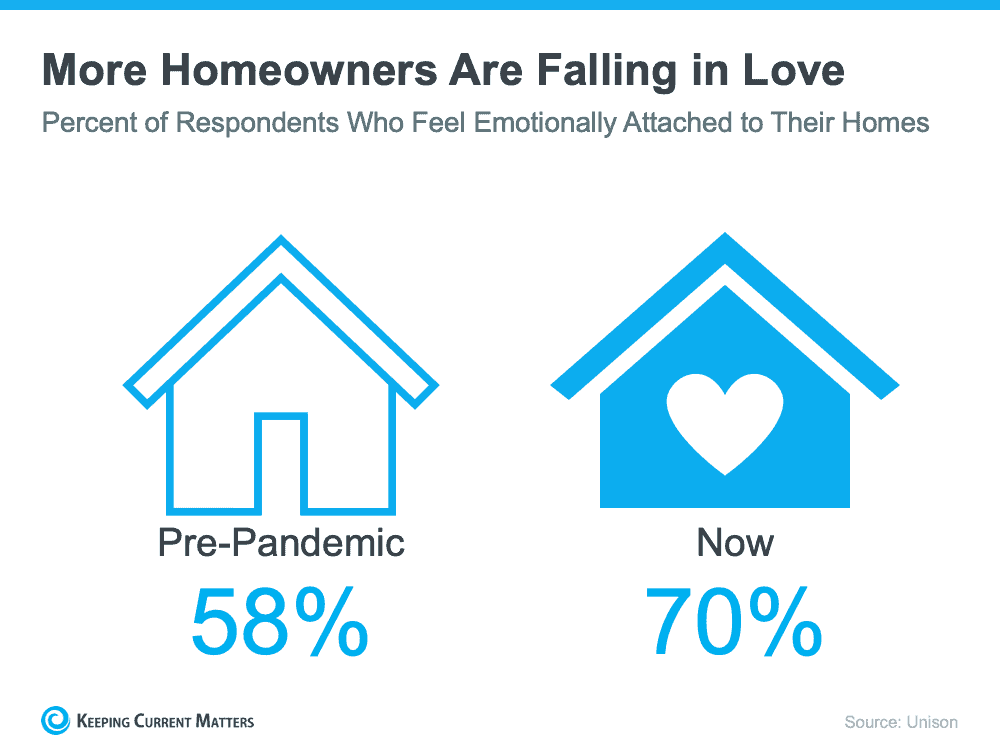

Financial benefits are always a key aspect of homeownership, but it’s also important to understand that the nonfinancial and personal benefits are why so many people genuinely fall in love with their homes. When you own your home, you likely feel a sense of emotional attachment because of the comfort it provides, but also because it’s a space that’s truly yours.

Over the past two years, we’ve learned to love our homes even more as we’ve stayed home more than ever due to the ongoing pandemic. As a result, the personal and emotional benefits our homes provide have become even more important to us.

As the most recent State of the American Homeowner from Unison puts it:

“Despite the upheaval and uncertainty of the past year, one thing has stayed the same: the home continues to be of the utmost importance and a place of security and comfort.”

When the health crisis began, the world around us changed almost overnight, and our homes were redefined. Our needs shifted, and our shelters became a place that protected us on a whole new level. The same study from Unison notes:

91% of homeowners say they feel secure, stable, or successful owning a home

64% of American homeowners say living through a pandemic has made their home more important to them than ever

83% of homeowners say their home has kept them safe during the COVID-19 pandemic

It’s no surprise this study also reveals that homeowners now love their homes even more as our emotional attachments to them have grown:

That sense of emotional connection genuinely reaches far beyond the financial aspect of homeownership. Because they’re our shelters – ones that we can genuinely call our own. Our homes touch our hearts and can also positively impact our mental health.

As JD Esajian, President of CT Homes, LLC, says:

“Aside from the financial factors, there are several social benefits of homeownership and stable housing to consider. It has long been thought that buying a home contributes to a sense of accomplishment. Still, most individuals fail to realize that homeownership can benefit your mental health and the community around you.”

Whether you’re thinking of buying your first home, moving up to your dream home, or downsizing to something that better fits your changing lifestyle, take a moment to reflect on what Mark Fleming, Chief Economist at First American, notes:

“Buying a home is not just a financial decision. It’s also a lifestyle decision.”

Bottom Line

There are so many reasons to fall head over heels for homeownership.

Your home will provide a place to customize and call your own, in addition to stability and security.

If you’re ready to fall in love with homeownership, contact a real estate professional today to get started on your homebuying journey today.

Owning Is More Affordable Than Renting in Most of the Country

If you were thinking about buying a home this year, but already pressed pause on your plans due to rising home prices and increasing mortgage rates, there’s something you should consider. According to the latest report from ATTOM Data, owning a home is more affordable than renting in the majority of the country. The 2022 Rental Affordability Report says:

“. . . Owning a median-priced home is more affordable than the average rent on a three-bedroom property in 666, or 58 percent, of the 1,154 U.S. counties analyzed for the report. That means major home ownership expenses consume a smaller portion of average local wages than renting.”

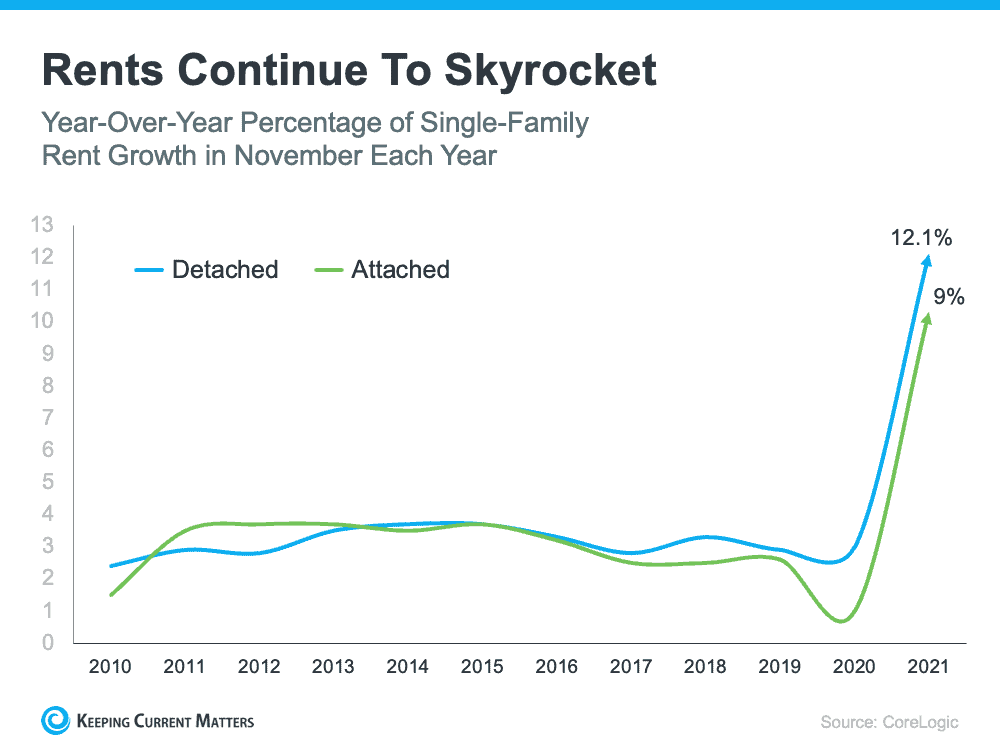

Other experts in the industry offer additional perspectives on renting today. In the latest Single-Family Rent Index from CoreLogic, single-family rent saw the fastest year-over-year growth in over 16 years when comparing data for November each year (see graph below):

Molly Boesel, Principal Economist at CoreLogic, stresses the importance of what the data shows:

“Single-family rent growth hit its sixth consecutive record high. . . . Annual rent growth . . . was more than three times that of a year earlier. Rent growth should continue to be robust in the near term, especially as the labor market continues to improve.”

What Does This Mean for You?

While it’s true home prices and mortgage rates are rising, so are monthly rents. As a prospective buyer, rising rates and prices shouldn’t be enough to keep you on the sideline, though. As the chart above shows, rents are skyrocketing. The big difference is, when you rent, that rising cost benefits your landlord’s investment strategy, but it doesn’t deliver any sort of return for you.

In contrast, when you buy a home, your monthly mortgage payment serves as a form of forced savings. Over time, as you pay down your loan and as home values rise, you’re building equity (and by extension, your own net worth). Not to mention, you’ll lock in your mortgage payment for the duration of your loan (typically 15 to 30 years) and give yourself a stable and reliable monthly payment.

When asking yourself if you should keep renting or if it’s time to buy, think about what Todd Teta, Chief Product Officer at ATTOM Data, says:

“. . . Home ownership still remains the more affordable option for average workers in a majority of the country because it still takes up a smaller portion of their pay.”

If buying takes up a smaller portion of your pay and has benefits renting can’t provide, the question really becomes: is renting really worth it?

Bottom Line

If you’re weighing your options between renting and buying, it’s important to look at the full picture.

While buying a home can feel like a daunting process, having a trusted advisor on your side is key.

Work with an agent to explore your options so you can learn more about the benefits of homeownership today.

Why A Move Could Bring You More Happiness

Over the past two years, we’ve lived through one of the most stressful periods in recent history. Because of the health crisis, many of us have spent more time at home and that’s led us to re-evaluate both what we need in a house and how much we appreciate having a safe space. If you’ve found your current home isn’t filling all your needs, you may be wondering if it’s time to find a new one.

There’s reason to believe a change of scenery could boost your happiness. Catherine Hartley, an Assistant Professor at New York University’s Department of Psychology and co-author of a study on how new experiences impact happiness, says:

“Our results suggest that people feel happier when they have more variety in their daily routines—when they go to novel places and have a wider array of experiences.”

A move could be exactly the new experience you’ve been looking for. If that’s something you’re considering to better your lifestyle, here are a few things to keep in mind.

Approach Your Decision Thoughtfully and Explore Your Options

Buying and selling a home is a major life change, and it’s not a decision you should enter lightly. But, if you’re questioning whether or not a move would bring you more happiness, it’s important to explore if it’s the right choice for you.

To find out more and discuss your options, reach out to a local real estate professional. They’ll explain the process – including how to list your existing house and search for a new one – in clear and simple terms.

You should also think about your lifestyle and what you’re hoping to get out of your move. What needs aren’t being met in your current home? What features would bring you more joy and make your life easier? For example, are you now working remotely and need a home office? Do you crave more fresh air and open outdoor space to unwind in? Knowing the answers to these questions can help you get started and position your real estate advisor to work with you so you can find just the right home.

Consider a Location with Weather That Will Boost Your Mood

Home features aren’t the only thing to consider. You should also weigh your options when it comes to location. Is the weather something that’s important to you? Does it have a tendency to impact your mood? If it does, you may want to factor it into your next move. The World Population Review shares:

“What states have the best weather? When evaluating each state for temperature, rain, and sun, some states stand out. . . . Climate and weather preferences are personal and subjective. . . . “

Better weather can mean different things to different people. Some prefer the heat, others cooler temperatures, and some want to experience all four seasons. Think about what makes you feel happiest and prioritize that in your home search. If you’re moving to a whole new location, your agent is a great resource with a strong network to support you along the way.

Bottom Line

Moving could provide you with a fresh beginning and the chance to find happiness in your new home.

Contact a local real estate advisor today to talk about your goals and options in the current market.

Why Right Now Is A Once In A Lifetime Opportunity For Sellers

If you’re thinking about selling your house in 2022, you truly have a once-in-a-lifetime opportunity at your fingertips. When selling anything, you always hope for strong demand for the item coupled with a limited supply. That maximizes your leverage when you’re negotiating the sale. Home sellers are in that exact situation right now. Here’s why.

Demand Is Very Strong

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), 6.18 million homes were sold in 2021. This was the largest number of home sales in 15 years. Lawrence Yun, Chief Economist for NAR, explains:

“Sales for the entire year finished strong, reaching the highest annual level since 2006. . . . With mortgage rates expected to rise in 2022, it’s likely that a portion of December buyers were intent on avoiding the inevitable rate increases.”

Demand isn’t expected to weaken this year, either. In addition, the Mortgage Finance Forecast, published last week by the Mortgage Bankers’ Association (MBA), calls for existing-home sales to reach 6.4 million homes this year.

Supply Is Very Limited

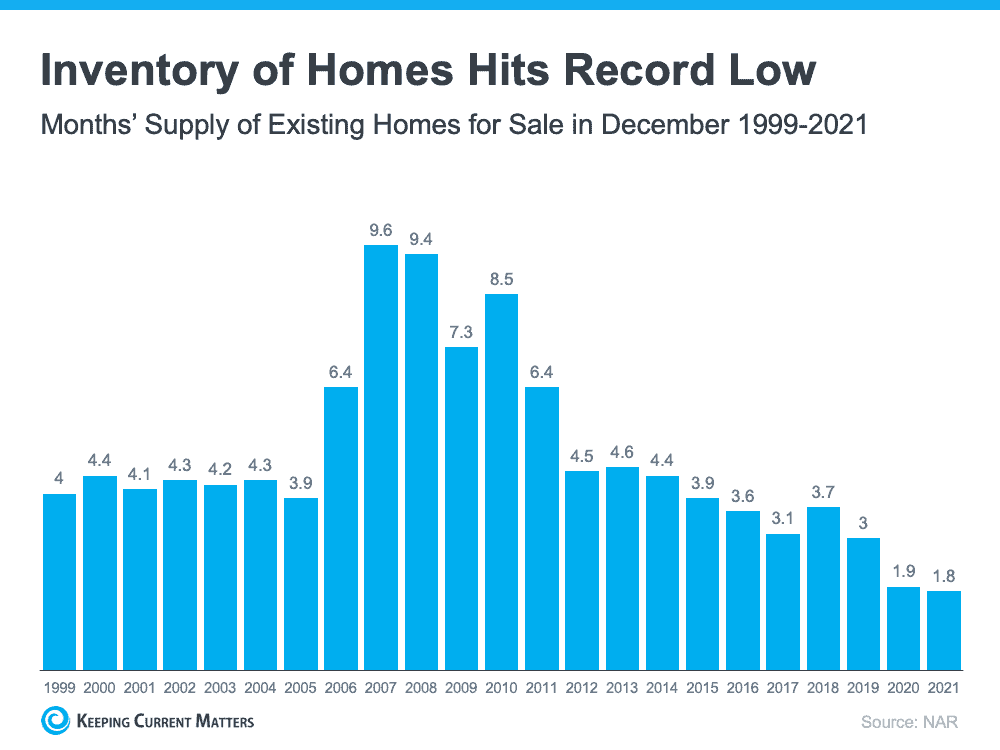

The same sales report from NAR also reveals the months’ supply of inventory just hit the lowest number of the century. It notes:

“Total housing inventory at the end of December amounted to 910,000 units, down 18% from November and down 14.2% from one year ago (1.06 million). Unsold inventory sits at a 1.8-month supply at the present sales pace, down from 2.1 months in November and from 1.9 months in December 2020.”

The reality is, inventory decreases every year in December. That’s just how the typical seasonal trend goes in real estate. However, the following graph emphasizes how this December was lower than any other December going all the way back to 1999.

Right Now, Sellers Have Maximum Leverage

As mentioned above, when there’s strong demand for an item and a limited supply of it available, the seller has maximum leverage in the negotiation. In the case of homeowners who are thinking about selling, there may never be a better time than right now. While demand is this high and inventory is this low, you’ll have leverage in all aspects of the sale of your house.

Today’s buyers know they need to be flexible negotiators that make very competitive offers, so here are a few areas that could tip in your favor when your house goes on the market:

Competitive sales price

Flexible closing date

Potential for a leaseback to allow you more time to find a home

Minimal offer contingencies

Bottom Line

If you’re thinking of selling your house this year, now is the optimal time to list it.

Contact a local real estate professional to learn more about putting your house on the market today.

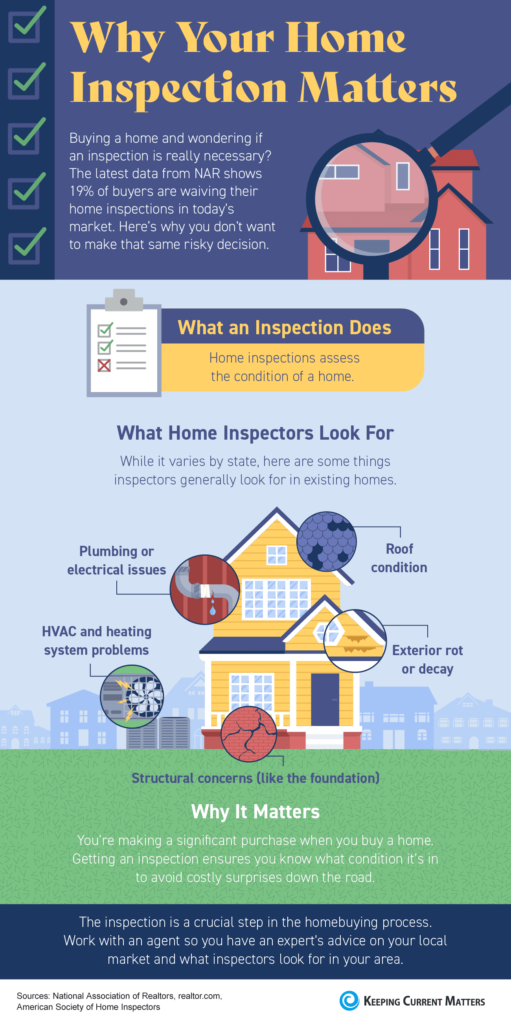

Why Your Home Inspection Matters

Some Highlights

- Buying a home and wondering if your inspection is necessary? While some buyers may decide to waive their inspection, it’s risky decision.

- Your home inspection is a crucial step in the homebuying process. It assesses the condition of the home you plan to purchase, so you can avoid costly surprises down the road.

- Work with an agent so you have expert advice and a trusted professional who will keep your interests top of mind.

Why Pre-Approval is Key For Homebuyers

You may have heard that it’s important to get pre-approved for a mortgage at the beginning of the homebuying process, but what does that really mean, and why is it so important? Especially in today’s market, with rising home prices and high buyer competition, it’s crucial to have a pre-approval letter prior to making an offer. Here’s why.

Being intentional and competitive are musts when buying a home this year. Pre-approval from a lender is the only way to know your true price range and how much money you can borrow for your loan. Just as important, being able to present a pre-approval letter shows sellers you’re a qualified buyer, something that can really help you land your dream home in an ultra-competitive market.

With limited housing inventory, there are many more buyers active in the market than there are sellers, and that’s creating some serious competition. According to the National Association of Realtors (NAR), homes today are receiving an average of 3.8 offers for sellers to consider. As a result, bidding wars are still common. Pre-approval gives you an advantage if you get into a multiple-offer scenario, and these days, it’s likely you will. When a seller knows you’re qualified to buy the home, you’re in a better position to potentially win the bidding war.

Freddie Mac explains:

“By having a pre-approval letter from your lender, you’re telling the seller that you’re a serious buyer, and you’ve been pre-approved for a mortgage by your lender for a specific dollar amount. In a true bidding war, your offer will likely get dropped if you don’t already have one.”

Every step you can take to gain an advantage as a buyer is crucial when today’s market is constantly changing. Interest rates are rising, prices are going up, and lending institutions are regularly updating their standards. You’re going to need guidance to navigate these waters, so it’s important to have a team of professionals such as a loan officer and a trusted real estate advisor making sure you take the right steps and can show your qualifications as a buyer when you find a home to purchase.

Bottom Line

In a competitive market with low inventory, a pre-approval letter is a game-changing piece of the homebuying process.

Not only does being pre-approved bring clarity to your homebuying budget, but it shows sellers how serious you are about purchasing a home.

When you’re ready, reach out to your local real estate professional.

Now’s The Time To Act, Mortgage Rates Are Climbing

Last week, the average 30-year fixed mortgage rate from Freddie Mac jumped from 3.22% to 3.45%. That’s the highest point it’s been in almost two years. If you’re thinking about buying a home, this news may have come as a bit of a shock. But the truth is, it wasn’t entirely unexpected. Experts have been calling for rates to rise in their 2022 projections, and the forecast is now becoming a reality. Here’s a look at the projections from Freddie Mac for this year:

- Q1 2022: 3.4%

- Q2 2022: 3.5%

- Q3 2022: 3.6%

- Q4 2022: 3.7%

As the numbers show, this jump in rates is in line with the expectations from Freddie Mac. And what they also indicate is that mortgage rates are projected to continue climbing throughout the year. But should you be worried about rising mortgage rates? What does that really mean for you?

As rates increase even modestly, they impact your monthly mortgage payment and overall affordability. If you’re looking to buy a home, rising mortgage rates should be an incentive to act sooner rather than later.

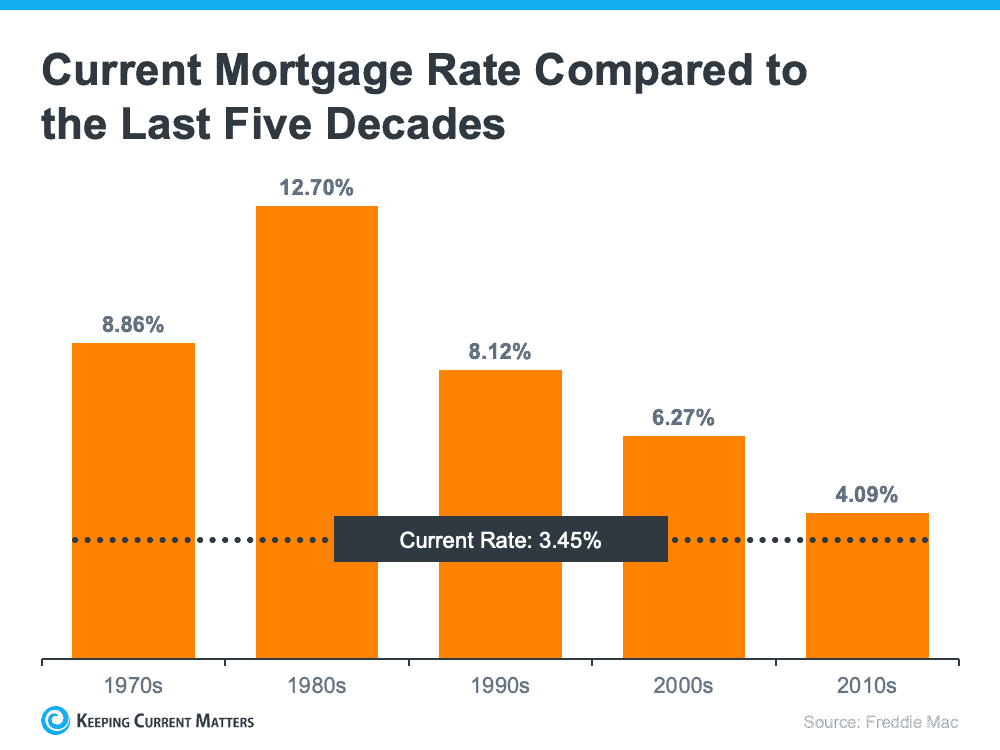

The good news is, even though rates are climbing, they’re still worth taking advantage of. Historical data shows that today’s rate, even at 3.45%, is still well below the average for each of the last five decades (see chart below):

That means you still have a great opportunity to buy now with a rate that’s better than what your loved ones may have paid in decades past. If you buy a home while rates are in the mid-3s, your monthly mortgage payment will be locked in at that rate for the life of your loan. As you can see from the chart above, a lot can change in that time frame. Buying now is a great way to protect yourself from rising costs and future rate increases while also securing your payment amount for the long term.

Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), says:

“Mortgage rates surged in the second week of the new year. The 30-year fixed mortgage rate rose to 3.45% from 3.22% the previous week. If inflation continues to grow at the current pace, rates will move up even faster in the following months.”

Bottom Line

Mortgage rates are increasing, and they’re forecast to be even higher by the end of 2022.

If you’re planning to buy this year, acting soon may be your most affordable option.

Work with a trusted advisor to start the homebuying process today.

Sellers: Don’t Wait Until Spring to Sell

As you plan out your goals for the year, moving up to your dream home may top the list. But, how do you know when to make your move? You want to time it just right so you can get the most out of the sale of your current house. You also want to know you’re making a good investment when you buy your new home. What you may not realize is, that opportunity to get the best of both worlds is already here.

You don’t want to wait until spring to spring into action. The current market conditions make this winter an ideal time to move. Here’s why.

1. The Number of Homes on the Market Is Still Low

Today’s limited supply of houses for sale is putting sellers in the driver’s seat. There are far more buyers in the market than there are homes available, and that means buyers are eagerly waiting for your house. Listing your house now makes it the center of attention. As a seller, that means when it’s priced correctly, you can expect it to sell quickly and get multiple strong offers this season. Just remember, experts project more inventory will come to market as we move through the winter months. The realtor.com 2022 forecast says this:

“After years of declining, the inventory of homes for sale is finally expected to rebound from all-time lows.”

Selling now may help you maximize the return on your investment before your house has to face more competition from other sellers.

2. Your Equity Is Growing in Record Amounts

Current homeowners are sitting on record amounts of equity thanks to today’s home price appreciation. According to the latest report from CoreLogic, the average homeowner gained $56,700 in equity over the past 12 months.

That much equity can open doors for you to make a move. If you’ve been holding off on selling because you’re worried about how rising prices will impact your own home search, rest assured your equity can help fuel your next move. It may be just what you need to cover a large portion – if not all – of the down payment on your next purchase.

3. While Rising, Mortgage Rates Are Still Historically Low

In January of last year, mortgage rates hit the lowest point ever recorded. Today, rates are starting to rise, but that doesn’t mean you’ve missed out on locking in a low rate. Current mortgage rates are still far below what they’ve been in recent decades:

- In the 2000s, the average mortgage rate was 6.27%

- In the 1990s, the average rate was 8.12%

Even with mortgage rates rising above 3%, they’re still worth taking advantage of. You just want to do so sooner rather than later. Experts are projecting rates will continue to rise throughout this year, and when they do, it’ll cost you more to purchase your next home.

4. Home Prices Are Going To Keep Rising with Time

According to industry leaders, home prices will also continue appreciating this year. While experts are forecasting more moderate home price growth than last year, it’s important to note prices will still be moving in an upward direction throughout 2022.

What does that mean for you? If you’re selling so you can move into a bigger home or downsize to the home of your dreams, you want to consider moving now before rates and prices rise further. If you’re ready, you have an opportunity to get ahead of the curve by purchasing your next home before rates and prices climb higher.

Bottom Line

If you’re considering selling to move up or downsize, this may be your moment, especially with today’s low mortgage rates and limited inventory.

Reach out to a local real estate professional today to get set up for homebuying success this year.

Two Ways Homebuyers Can Win In Todays Market

If your goal is to purchase a home this year, you might be looking for any advantage you can get in today’s sellers’ market. While competition is still fierce for homebuyers, there are ways you can win and secure the home of your dreams, even in a hot market.

Act Early and Save

The earlier you act this year, the more affordable your purchase will be. That’s because experts project mortgage rates will rise as we move deeper into 2022. According to Freddie Mac, the average 30-year fixed-rate mortgage is expected to be 3.5% by year’s end. Experts forecast home prices will rise as well.

That means the longer you wait, the more it will cost you to buy a home. Instead, act early and purchase your home before rates and prices rise further. Not to mention, the sooner you buy, the sooner you can experience the benefits of continued home price appreciation yourself. Once you have your home, you’ll be able to watch its value rise, giving you confidence that your investment is a sound one.

Buy Now, Move Later

Keep in mind, with high buyer demand like we’re seeing today, you’ll be competing against other potential homebuyers, which means you need to find a way to stand out. One way to accomplish this is to negotiate with sellers and present terms that meet their ideal needs. Danielle Hale, Chief Economist for realtor.com, explains one lever flexible buyers can pull to entice sellers:

“For buyers with more flexible timelines – such as those making a move from a big city – offering a couple extra months on the closing date could sweeten the deal for sellers who also need to buy their next home.”

In other words, if you’re eager to purchase a home now before it becomes more costly and you don’t have to move right away, you could extend the date of your closing and provide the seller with the time they need to find their next home. That’s a deal that could benefit both parties and help you stand out from the crowd.

Of course, it’s important to work with a real estate professional for expert advice on how to make your best offer. Your trusted advisor knows what’s working in your market and what may appeal to sellers.

Bottom Line

Experts project home prices and rates will increase in 2022.

That means buyers who are ready should act soon and find ways to strengthen their offer to meet sellers’ needs.

Reach out to a trusted real estate advisor today to learn how you can win in today’s market.