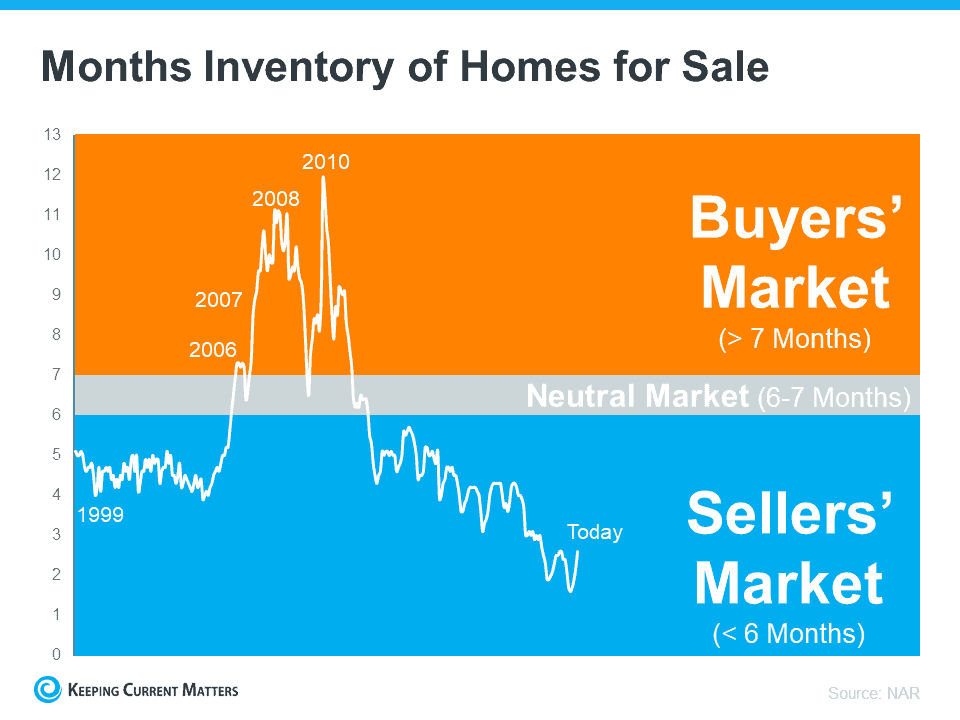

If you’re thinking of buying a home today, you already know that the number of homes available for sale is low. But what does that really mean for you? As a buyer, low housing supply coupled with high buyer demand means you should be prepared to navigate a highly competitive market where homes sell fast and get multiple offers. Realtor.com has this to say:

“Homes also flew off the market at record pace as buyers put offers in the moment properties came up for sale….”

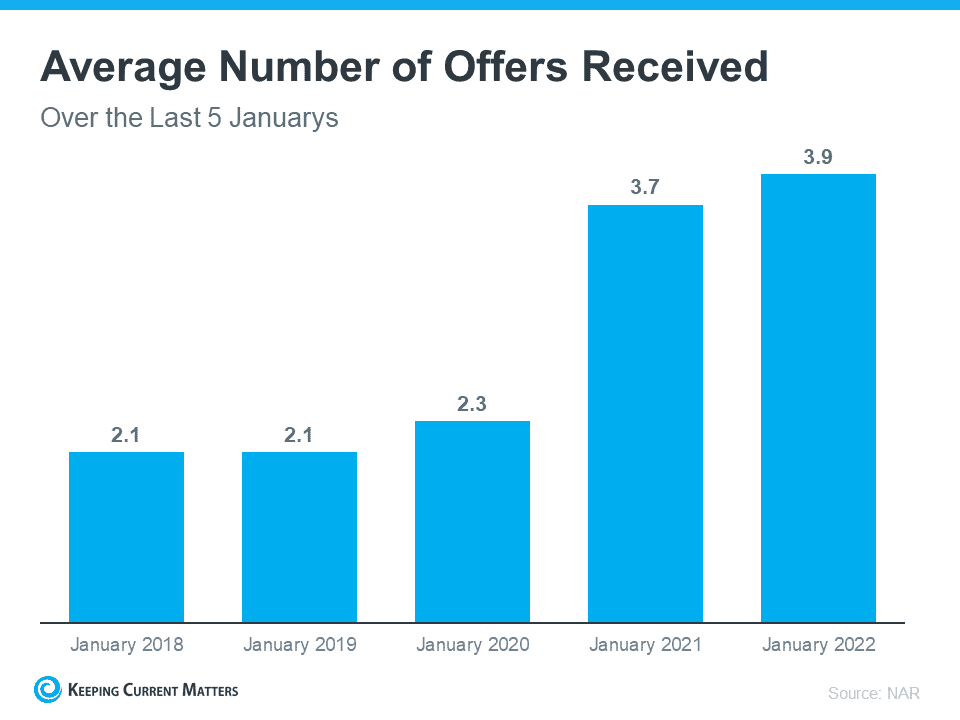

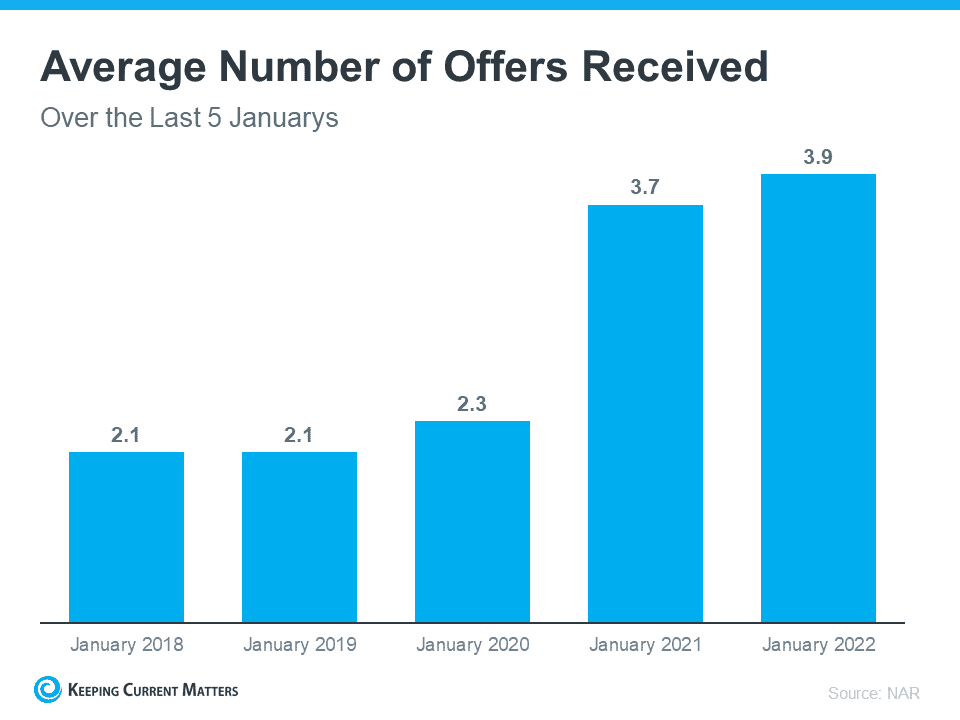

In a bidding war situation like this, doing everything you can to get ahead of the competition is a wise move. That’s because when you find a house and submit an offer, it’ll likely be up against strong offers from other buyers. According to the latest Realtors Confidence Index from the National Association of Realtors (NAR), homes today are receiving an average of 3.9 offers. That’s the most offers we’ve seen in January for the last 5 years (see graph below):

To help you navigate bidding wars with multiple offers, an expert real estate advisor is key. They know what’s worked for other buyers, what sellers are looking for, and how to help you prepare when it comes time to make an offer. Here are three tips to keep in mind that will help you make the best offer possible.

1. Know Your Numbers

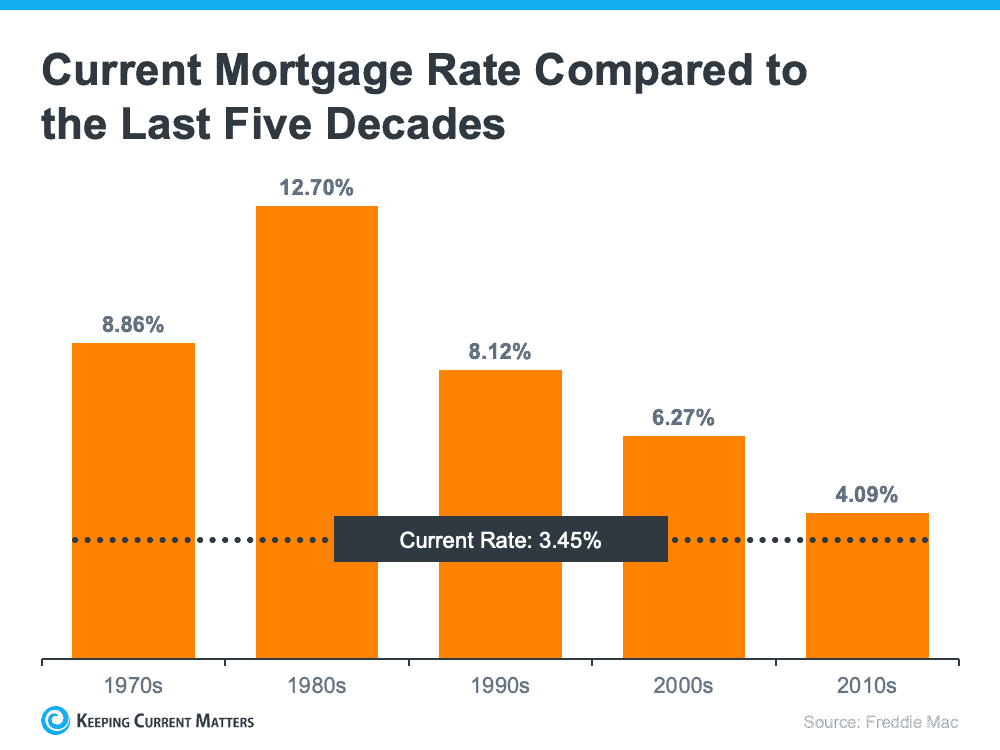

Knowing your budget and what you can afford is critical to your success as a homebuyer. The best way to understand your numbers is to work with a lender so you can get pre-approved for a loan. Pre-approval shows sellers you’re serious, which can give you a competitive edge. You should also know making an offer at the home’s asking price may not be enough. Homes today often sell for more than their listing price. An agent can help you understand the market value of the home and what other homes are selling for in your area.

2. Be Ready To Move Fast

Speed and the pace of sales are contributing factors to today’s competitive housing market. When homes are selling fast, it’s important to stay on top of the market and be ready to move quickly. Your agent will help you stay up to date on the latest listings and help you put together your best offer as soon as you find the home you want to buy.

3. Make a Strong but Fair Offer

When you’re up against other offers, putting your best offer forward from the start is key. Lean on your agent to write a strong offer and use their expertise on which levers you can pull to make your offer as enticing as possible. One option is to wave some of your contract contingencies (conditions you set that the seller must meet for the purchase to be finalized). Just remember there are certain contingencies you don’t want to give up, like the home inspection.

Bottom Line

No matter what, your agent is your best resource for making an offer that stands out in a competitive market.

If you’re ready to get started, reach out to a real estate professional to talk through what you can expect as a buyer and how to kick off a successful home search.

source