Some Highlights:

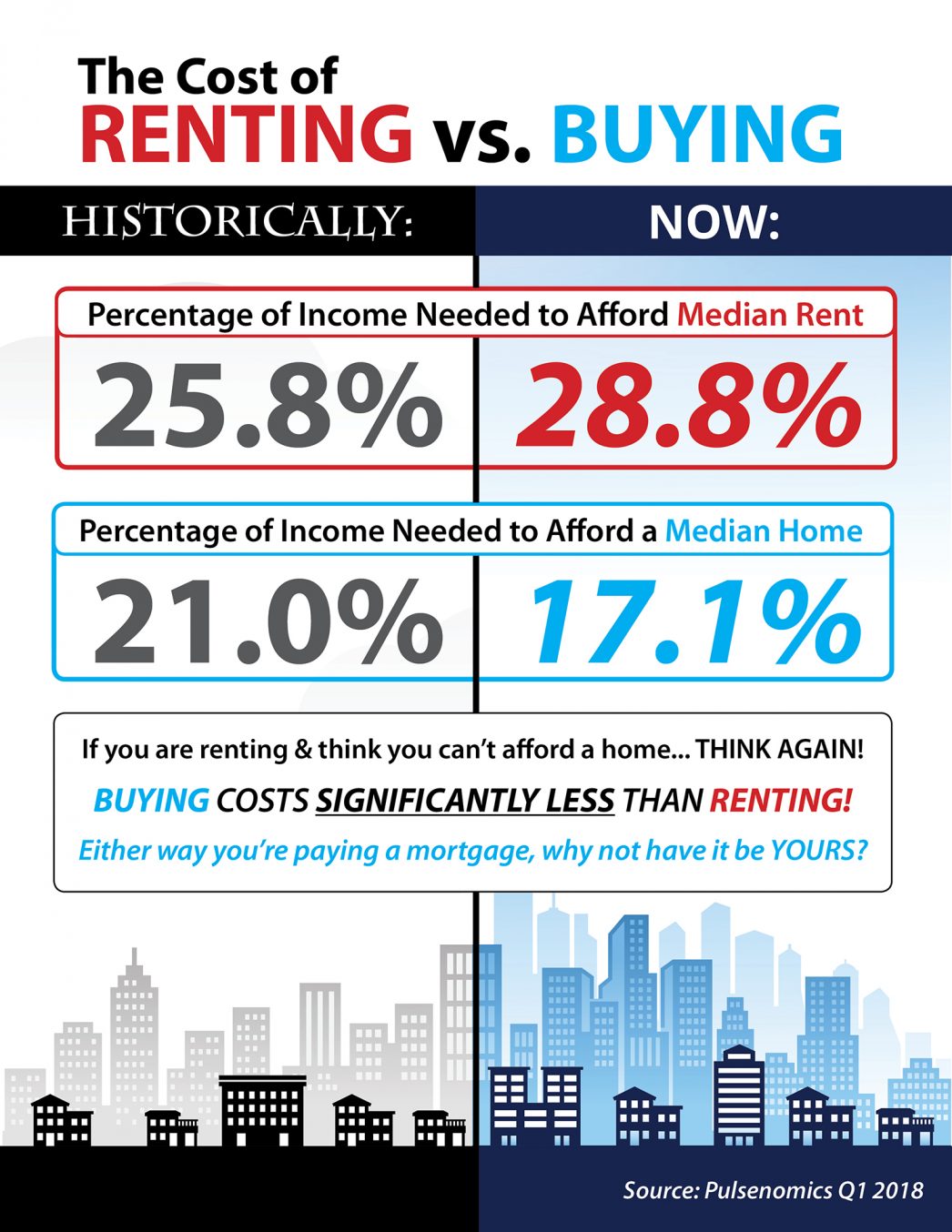

*Historically, the choice between renting or buying a home has been a tough decision.

*Looking at the percentage of income needed to rent a median-priced home today (28.8%) vs. the percentage needed to buy a median-priced home (17.1%), the choice becomes obvious.

*Every market is different. Before you renew your lease again, find out if you can put your housing costs to work by buying this year!

*Before you renew your lease again, find out if you can put your housing costs to work by buying this year!

*Contact a real estate professional to assist you.

Tag Archives: buying a home

4 Reasons Why Summer is A Great Time to Buy A Home

Here are four great reasons to consider buying a home today instead of waiting.

1. Prices Will Continue to Rise

CoreLogic’s latest Home Price Insights reports that home prices have appreciated by 7% over the last 12 months. The same report predicts that prices will continue to increase at a rate of 5.2% over the next year.

Home values will continue to appreciate for years. Waiting no longer makes sense.

2. Mortgage Interest Rates Are Projected to Increase

Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage have increased by half a percentage point already in 2018 to around 4.5%. Most experts predict that rates will rise over the next 12 months. The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are in unison, projecting that rates will increase by nearly a full percentage point by this time next year.

An increase in rates will impact YOUR monthly mortgage payment. A year from now, your housing expense will increase if a mortgage is necessary to buy your next home.

3. Either Way, You Are Paying a Mortgage

There are some renters who have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to have equity in your home that you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

Are you ready to put your housing cost to work for you?

4. It’s Time to Move on with Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise.

But what if they weren’t? Would you wait?

Look at the actual reason you are buying and decide if it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer, or you just want to have control over renovations, maybe now is the time to buy.

If the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings.

Make sure to hire a real estate professional to assist you in your home buying!

If you’re in the South Florida area, contact Tara Burner for all of your real estate needs.

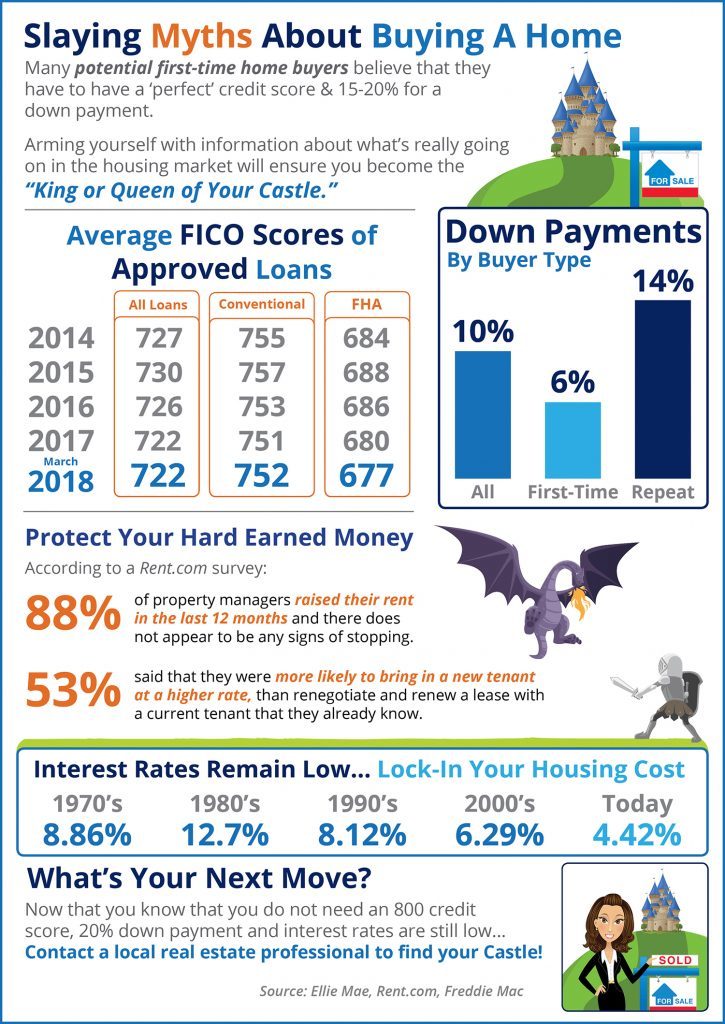

Slaying Myths About Buying A Home

If you’re afraid you can’t buy a home, lets slay some of those popular myths right here and now and show you that you may be closer to buying a home of your own than you realize!

You don’t have to have 20% for a down payment nor perfect credit! Those are the two biggest myths and as you can see below, they’re just that…myths!

Are you ready to see about buying your home?!

Call or text me at 954-549-3393 if you’re in the South Florida area.

I’d be more than glad to find the ideal home for you!

Or you can visit www.TaraBurner.net to browse the listings and get more info regarding buying a home.

3 Tips for Making Your Dream Home a Reality

Some Highlights:

Setting up an automatic savings plan that saves a small amount of every check is one of the best ways to save without thinking much about it.

Living within a budget right now will help you save money for down payments while also paying down other debts that might be holding you back.

What are you willing to cut back on to make your dreams of homeownership a reality?

Buying a Home Guide

When you’re getting ready to buy a home, there are a lot of factors you want to take into consideration without getting overwhelmed.

Below you can get a free home buying guide that helps you step by step from the current housing market, what you need to know before you buy a home, what to expect when buying a home, and all the steps in between!

Click here for your free guide

(will open new window for pdf format guide)

If you have any questions, feel free to contact me