While higher mortgage rates are creating affordability challenges for homebuyers this year, there is some good news for those people still looking to buy a home.

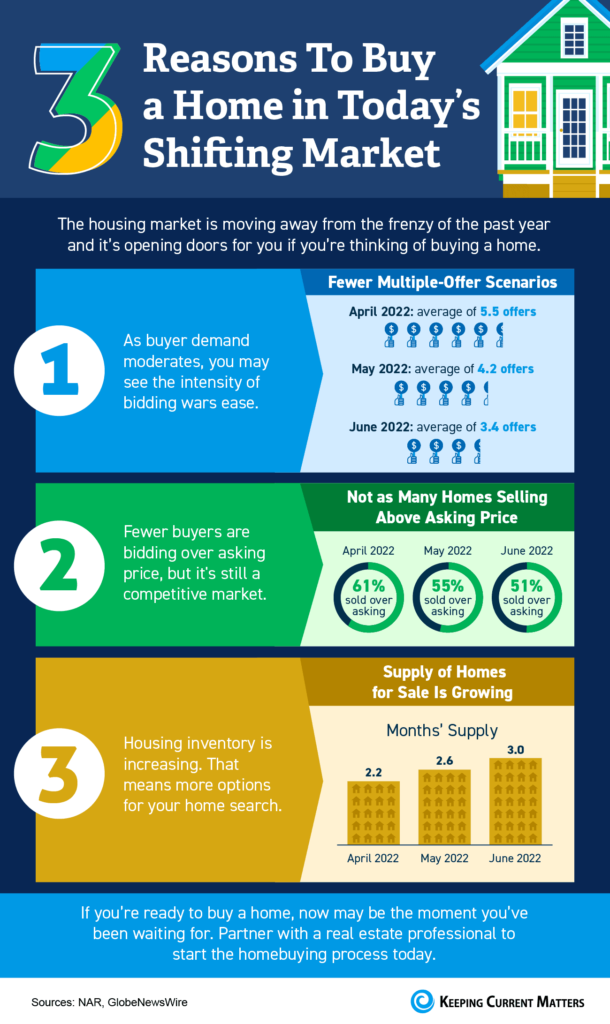

As the market has cooled this year, some of the intensity buyers faced during the peak frenzy of the pandemic has cooled too. Here are just a few trends that may benefit you when you go to buy a home today.

1. More Homes To Choose from

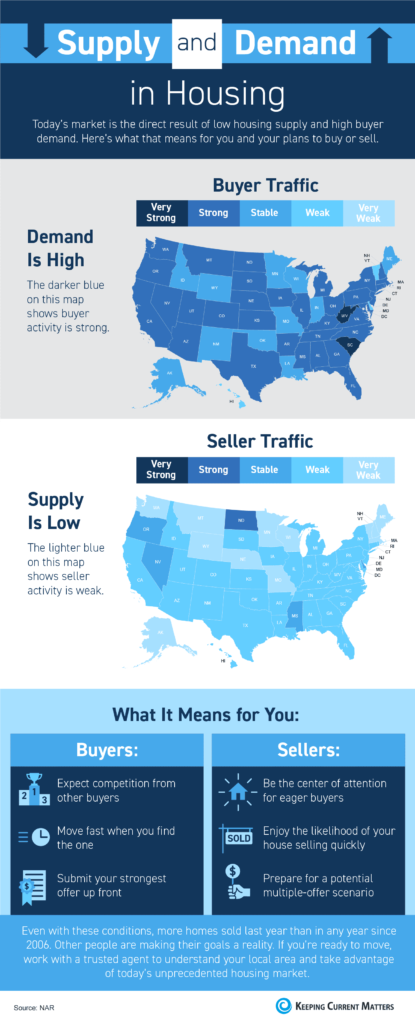

During the pandemic, housing supply hit a record low at the same time buyer demand skyrocketed. This combination made it difficult to find a home because there just weren’t enough to meet buyer demand. According to Calculated Risk, the supply of homes for sale increased by 39.5% for the week ending October 28 compared to the same week last year.

Even though it’s still a sellers’ market and supply is still lower than more normal levels, you have more to choose from in your home search. That makes finding your dream home a bit less difficult.

2. Bidding Wars Have Eased

One of the top stories in real estate over the past two years was the intensity and frequency of bidding wars. But today, things are different. With more options, you’ll likely see less competition from other buyers looking for homes. According to the National Association of Realtors (NAR), the average number of offers on recently sold homes has declined. This September, the average was 2.5 offers per sale. In contrast, last September, the average was 3.7 offers per sale.

If you tried to buy a house over the past two years, you probably experienced the bidding war frenzy firsthand and may have been outbid on several homes along the way. Now you have a chance to jump back into the market and enjoy searching for a home with less competition.

3. More Negotiation Power

And when you have less competition, you also have more negotiating power as a buyer. Over the last two years, more buyers were willing to skip important steps in the homebuying process, like the appraisal or inspection, to try to win a bidding war. But the latest data from the National Association of Realtors (NAR) shows the percentage of buyers waiving those contingencies is going down.

As a buyer, this is good news. The appraisal and the inspection give you important information about the value and condition of the home you’re buying. And if something turns up in the inspection, you have more power today to renegotiate with the seller.

A survey from realtor.com confirms more sellers are accepting offers that include contingencies today. According to that report, 95% of sellers said buyers requested a home inspection, and 67% negotiated with buyers on repairs as a result of the inspection findings.

Bottom Line

While buyers still face challenges today, they’re not necessarily the same ones you may have been up against just a year or so ago. If you were outbid or had trouble finding a home in the past, now may be the moment you’ve been waiting for.

Partner with a local real estate professional to start the homebuying process today.