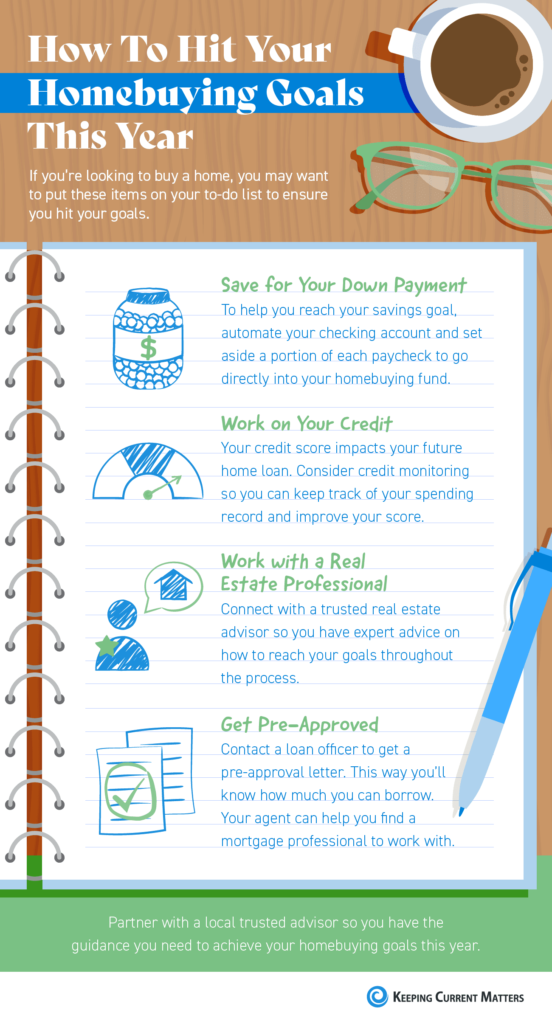

- If you’re looking to buy a home, you may want to put these items on your to-do list to ensure you hit your goals.

- It’s important to start working on your credit and saving for a down payment early. When you’re ready to begin your search, work with a real estate professional and get pre-approved so you know how much you can borrow.

- Connect with a real estate advisor so you have the guidance you need to achieve your homebuying goals this year.

Tag Archives: real estate tips

4 Ways Homeowners Can Use Equity In Their Home

Your equity is a powerful tool that can help you achieve your goals as a homeowner. And chances are, your equity grew substantially over the past year. According to the latest Equity Insights Report from CoreLogic, homeowners gained an average of $51,500 in equity over the past year.

If you’re looking for the best ways to use your growing equity, here are four options:

1. Use Your Equity To Buy a Home That Fits Your Needs

If you’re finding you no longer have the space you need, it might be time to move into a larger home. Or, it’s possible you have too much space and would like something smaller. No matter the situation, consider using your equity to power a move into a home that fits your changing lifestyle. Moving into a larger home can provide extra space for remote work or loved ones. Downsizing, on the other hand, may mean saving time and money by caring for a smaller home.

2. Move to the Location of Your Dreams

If the size of your home isn’t a challenge but your current location is, it could be time to relocate to a new area. Maybe you enjoy vacationing in the mountains, at the beach, or another area, and you’re dreaming of living there year-round. Or perhaps the distance between you and your loved ones is greater than you’d like, and you want to close the gap. No matter what, your home equity can fuel your move to the location where you really want to live.

3. Start a New Business

If you’re not ready to move into a new home, you can use your equity to invest in a new business venture. As the U.S. Small Business Administration Office of Advocacy says:

“There is an estimate of 31.7 million small business owners in the United States, many of them started their business with the equity they had in their home.”

While it’s not recommended that homeowners use their equity for unnecessary spending, leveraging your equity to start a business that you’re passionate about can potentially grow your nest egg further.

4. Fund an Education

Whether you have a loved one preparing to head off to college or you’re planning to go back to school yourself, the thought of paying for higher education can be daunting. In either situation, using a portion of your growing equity can help with those costs, so you can make an investment in someone’s future.

Bottom Line

Your equity can help you achieve your goals.

If you’re unsure how much equity you have in your home, connect with a trusted real estate advisor so you can start planning your next move.

Struggling to Find A Home to Buy? Try New Construction

There’s no question that the financial benefits of selling a house are outstanding today. Now is truly a great time to list if you’re ready to make a change. But if you do sell your house right now, you may be wondering where you’ll go when you move.

With so few homes available to buy right now, you might be considering building a new home as one of your options. But you may be unsure if that’s the way to go. Let’s compare the benefits of a newly built home versus moving into an existing one, and why working with a real estate agent throughout the process is mission-critical to your success no matter what you decide.

The Pros of Newly Built Homes

First, let’s look at the benefits of purchasing a newly constructed home. With a brand-new home, you’ll be able to:

1. Create your perfect home.

If you build a home from the ground up, you’ll have the option to select the custom features you want, including appliances, finishes, landscaping, layout, and more.

2. Cash-in on energy efficiency.

When building a home, you can choose energy-efficient options to help lower your utility costs, protect the environment, and reduce your carbon footprint.

3. Minimize the need for repairs.

Many builders offer a warranty, so you’ll have peace of mind on unlikely repairs. Plus, you won’t have as many little projects to tackle. QuickenLoans puts it like this:

“Buying a new construction vs. existing home typically means you’ll have fewer repairs to do. It can be a huge relief to know that it’s unlikely you’ll have to repair the roof or replace the furnace.”

4. Have brand new everything.

Another perk of a new home is that nothing in the house is used. It’s all brand new and uniquely yours from day one.

The Pros of Existing Homes

Now, let’s compare that to the perks that come with buying an existing home. With a pre-existing home, you can:

1. Explore a wider variety of home styles and floorplans.

With decades of homes to choose from, you’ll have a broader range of floorplans and designs available.

2. Join an established neighborhood.

Existing homes give you the option to get to know the neighborhood, community, or traffic patterns before you commit.

3. Enjoy mature trees and landscaping.

Established neighborhoods also have more developed landscaping and trees, which can give you additional privacy and curb appeal. As Investopedia says, if you buy an existing home:

“Odds are, too, that the home will have mature landscaping, so you won’t have to worry about starting a lawn, planting shrubs, and waiting for trees to grow.”

4. Appreciate that lived-in charm.

The character of older homes is hard to reproduce. If you value timeless craftsmanship or design elements, you may prefer an existing home. According to Houseopedia:

“Charm is priceless. Existing homes, especially those built in the 1950’s or before, often offer architectural elements, historic charm and a quality of craftsmanship not available in new homes.”

The choice is yours. When you start your search for the perfect home, remember that you can go either route – you just need to decide which features and benefits are most important to you. Working with the guidance of your trusted real estate advisor will help you make the most informed and educated decision, so you can move into the home of your dreams.

Bottom Line

If you have questions about the options in your area, meet with a local real estate professional to discuss what’s available and what’s right for you.

Win When You Sell & When You Buy

If you’re trying to decide when to sell your house, there may not be a better time than this winter. Selling this season means you can take advantage of today’s strong sellers’ market when you make a move.

Win When You Sell

Right now, conditions are very favorable for current homeowners looking for a change. If you sell now, here’s what you can expect:

- Your House Will Stand Out – While recent data shows there are more sellers getting ready to list their homes this winter, there are still more buyers in the market than there are homes for sale. If you sell your house now before more houses are listed, it will get more attention from serious buyers who are eager to find a home.

- Your House Will Likely Get Multiple Offers – When supply is low and demand is high, buyers have to compete with each other for a limited number of homes. The latest Realtors Confidence Index from the National Association of Realtors (NAR) shows sellers are getting an average of 3.6 offers in today’s market.

- Your House Should Sell Quickly – According to the same report from NAR, homes are selling in an average of just 18 days. As a seller, that’s great news for you if you’re looking for a quick process.

Win When You Move

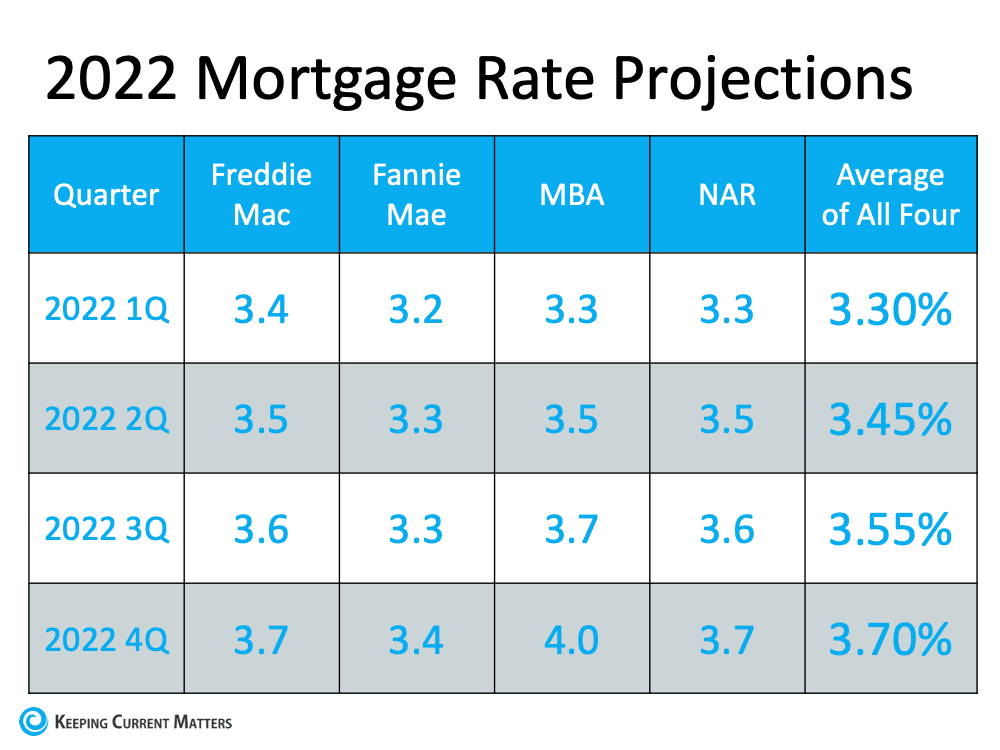

In addition to these great perks, you’ll also win big on your next move if you sell now. CoreLogic reports homeowners gained an average of $51,500 in equity over the past year. This wealth boost is the result of buyer competition driving home prices up. You can leverage that equity to fuel a move, before mortgage rates and home prices climb higher. To get a feel for how rates are projected to rise, see the chart below.

The longer you wait to make your move, the more it will cost you down the road. As mortgage rates rise, even modestly, it will impact your monthly payment when you purchase your next home. Waiting just a few months to make that change could mean a long-term financial impact.

The good news is today’s rates are still hovering in a historically low range. According to Doug Duncan, Senior VP and Chief Economist at Fannie Mae:

“Right now, we forecast mortgage rates to average 3.3 percent in 2022, which, though slightly higher than 2020 and 2021, by historical standards remains extremely low . . .”

Selling before rates climb higher means you can make your move and lock in a low rate on the mortgage for your next home. This helps you get more home for your money and keeps your payments down too.

Bottom Line

As a homeowner, you have a great opportunity to get the best of both worlds this season.

You can truly win when you sell and when you buy.

If you’re thinking about making a move, meet with a real estate professional to learn how to get the process started.

Tips For Single Homebuyers

If you’re living on your own and looking to buy a home, know that you can make your dream a reality with thoughtful planning and the right team of experts. Research from Freddie Mac shows 28% of all households (36.1 million) are sole-person, and that number is growing. Over the past 40 years, the number of sole-person households has nearly doubled, and that’s a trend that’s expected to continue. According to Freddie Mac:

“Our calculation suggests that there will be an additional 5 million sole-person households in the United States by the next decade. This means 42% of the household growth will be contributed by sole-person households, . . .”

If you fall into this category, here are three tips to help you achieve your homeownership goals.

1. Know Your Credit Score

When you buy a home on your own, you have to qualify for your loan based solely on your own finances and credit history. Investopedia says:

“. . . lenders will be looking at just one credit profile: yours. Needless to say, it has to be in great shape. It is always a good idea to review your credit report beforehand, and this is especially true of solo buyers.”

It’s important to find out your score so you know where it falls. If you’re not sure if it’s strong enough or where to focus your energy to improve it, meet with a professional for expert advice on your individual situation.

2. Explore Down Payment Options

Next, look into down payment programs so you can get a feel for what you’ll need to save to buy a home. Rob Chrane, CEO of Down Payment Resource, explains:

“Buyers should discuss their program options with their loan officer and real estate agent to make sure they choose the program best suited to their personal needs.”

In this step, lean on the pros to determine what you’re eligible for and what’s right for you.

3. Think About Your Future Home and Your Needs

You should also spend time thinking about what you want. What type of home do you picture yourself in? To answer that question, Quicken Loans shares this advice:

“Think about your lifestyle, what you want out of your home and your needs. Is being close to work important? Do you need a lot of yard space? Do you want an extra bedroom that you can transform into a home office? Condo or detached home? Lots of space for entertaining? It’s all up to you (and your budget).”

Again, a professional can help you balance what you want and how much you should spend on your monthly housing costs to determine what type of home is right for you.

While buying a home solo can feel like a big challenge, it doesn’t have to be. If you lean on the professionals, they can help you navigate these waters and make sure you’re able to take advantage of the great opportunities in today’s housing market (like low mortgage rates) to buy your dream home.

Bottom Line

The share of sole-person households is growing. If you’re looking to buy a home on your own, be confident that the dream is achievable.

When you’re ready to begin your search, work with the professionals so you have expert advice each step of the way.

Journey To Homeownership

- When it comes to buying a home, there are a number of key milestones along the way.

- The process includes everything from building your team and understanding your finances to going house hunting, making an offer, and more.

- When you’re ready to start your journey, partner with a professional so you have trusted guidance at every milestone in the process.

The Best Use of Time & Money With Renovations

In the current sellers’ market, many homeowners wonder what, if anything, needs to be remodeled before they list their house. That’s where a trusted real estate professional comes in. They can help you think through today’s market conditions and how they impact what you should – and shouldn’t – renovate before selling.

Here are some considerations a professional will guide you through:

1. With current supply challenges, buyers may be willing to take on projects of their own.

A more balanced market typically sees a 6-month supply of homes for sale. Above that, and we’re in a buyers’ market. Below that, and we’re in a sellers’ market. According to a recent report by the National Association of Realtors (NAR), our current supply of homes for sale, while rising, still remains solidly in sellers’ market territory:

“Unsold inventory sits at a 2.6-month supply at the current sales pace, modestly up from May’s 2.5-month supply but down from 3.9 months in June 2020.”

So, what’s that mean for you? If you’re a seller trying to decide whether or not to renovate, this is especially important because it’s indicative of buyer behavior. When there aren’t enough homes for sale, buyers may be more willing to purchase a home that doesn’t meet all their needs and renovate it themselves later.

2. Not all renovation projects are equal.

You don’t want to spend time and money on a project that isn’t worth the cost or is too niche design-wise for some homebuyers. According to an article by Renofi.com, basing home updates on what’s trendy right now can be a costly mistake:

“The last thing you as a homeowner want to do is center your home design around a passing fad – even worse, one thats design quality won’t last a good while.”

Before making any decisions, talk to your real estate advisor. They have insight into what other sellers are doing before listing their homes and how buyers are reacting to those upgrades. Don’t spend the time and money to be trendy – if your buyer wants to upgrade to the newest fad later, they can.

3. If you’ve already made upgrades this past year, your agent can help spotlight them.

If you have already completed some renovations on your house, you’re not alone. The pandemic kept people at home last year, and during that time, many homeowners completed some home improvement projects. HomeAdvisor’s 2021 State of Home Spending Report found:

“35% of households that completed an improvement project undertook some type of interior painting, while 31% completed a bathroom remodel and 26% installed new flooring.”

Let your real estate professional know if you fall in this category. They can highlight any recent upgrades you’ve made in your house’s listing.

Bottom Line

When it comes to renovations, your return-on-investment should be top of mind.

Talk with your local real estate professional to find out what projects you should prioritize before you sell and how to highlight your upgrades to maximize your house’s potential.

4 Tips to Maximize The Sale Of Your Home

Homeowners ready to make a move are definitely in a great position to sell today. Housing inventory is incredibly low, driving up buyer competition. This gives homeowners leverage to sell for the best possible terms, and it’s fueling a steady rise in home prices.

In such a hot market, houses are selling quickly. According to the National Association of Realtors (NAR), homes are typically on the market for just 18 short days. Despite the speed and opportunity for sellers, there are still steps you can take to prep your house to shine so you get the greatest possible return.

1. Make Buyers Feel at Home

One of the ways to make this happen is to take time to declutter. Pack away any personal items like pictures, awards, and sentimental belongings. The more neutral and tidy the space, the easier it is for a buyer to picture themselves living there. According to the 2021 Profile of Home Staging by NAR:

“82% of buyers’ agents said staging a home made it easier for a buyer to visualize the property as a future home.”

Not only will your house potentially attract the attention of more buyers and likely sell quickly, but the same report also notes:

“Eighteen percent of sellers’ agents said home staging increased the dollar value of a residence between 6% and 10%.”

As Jessica Lautz, Vice President of Demographics and Behavior Insights for NAR, says:

“Staging a home helps consumers see the full potential of a given space or property…It features the home in its best light and helps would-be buyers envision its various possibilities.”

2. Keep It Clean

On top of making an effort to declutter, it’s important to keep your house neat and clean. Before a buyer stops by, be sure to pick up toys, make the beds, and wash the dishes. This is one more way to reduce the number of things that can distract a buyer from the appeal of the home.

Ensure your home smells fresh and clean as well. Buyers will remember the smell of your house, and according to the same report from NAR, the kitchen is one of the most important rooms of the house to focus on if you want to attract more buyers.

3. Give Buyers Access

Buyers are less likely to make an offer on your house if they aren’t able to easily schedule a time to check it out. If your home is available anytime, that opens up more opportunities for multiple buyers to go from curious to eager. It also allows buyers on tight schedules to still get in to see your house.

While health continues to be a great concern throughout the country, it’s important to work with your agent to find the best safety measures and digital practices for your listing. This will drive visibility and create access options that also keep everyone in the process safe.

4. Price It Right

Even in a sellers’ market, it’s crucial to set your house at the right price to maximize selling potential. Pricing your house too high is actually a detriment to the sale. The goal is to drive high attention from competing buyers and let bidding wars push the final sales price up.

Work with your trusted real estate professional to determine the best list price for your house. Having an expert on your side in this process is truly essential.

Bottom Line

If you want to sell on your terms, in the least amount of time, and for the best price, today’s market sets the stage to make that happen.

Contact a local real estate professional today to determine the best ways to maximize the sale of your house this year.

3 Things To Prioritize When Selling Your Home

Today’s housing market is full of unprecedented opportunities. High buyer demand paired with record-low housing inventory is creating the ultimate sellers’ market, which means it’s a fantastic time to sell your house. However, that doesn’t mean sellers are guaranteed success no matter what. There are still some key things to know so you can avoid costly mistakes and win big when you make a move.

1. Price Your House Right

When inventory is low, like it is in the current market, it’s common to think buyers will pay whatever we ask when setting a listing price. Believe it or not, that’s not always true. Even in a sellers’ market, listing your house for the right price will maximize the number of buyers that see your house. This creates the best environment for bidding wars, which in turn are more likely to increase the final sale price. A real estate professional is the best person to help you set the best price for your house so you can achieve your financial goals.

2. Keep Your Emotions in Check

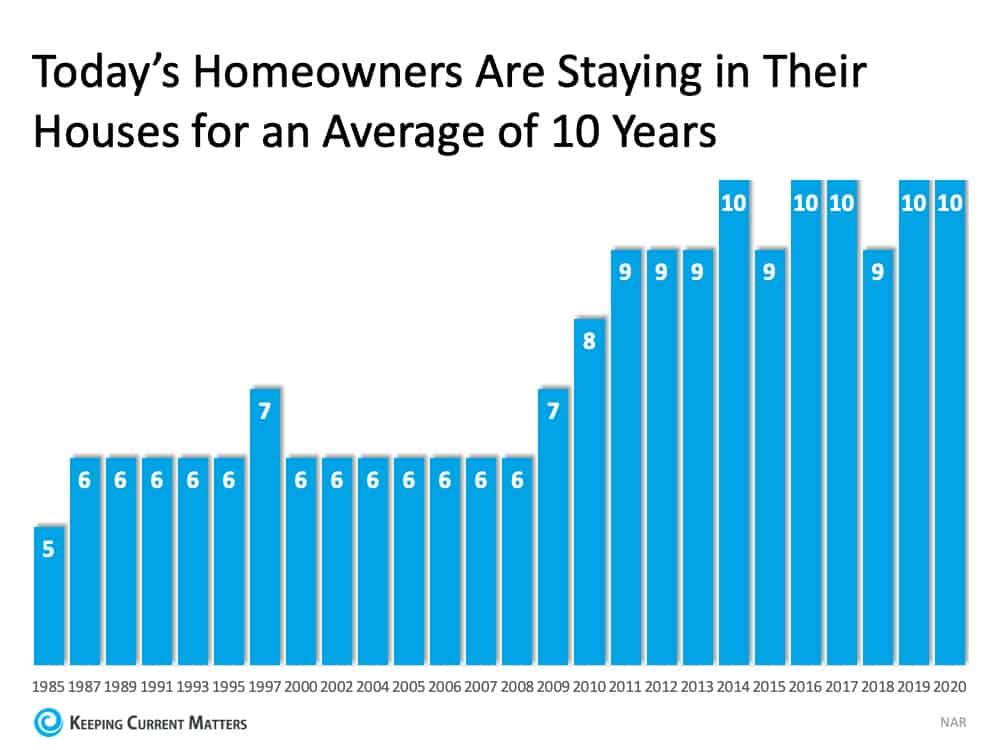

Today, homeowners are living in their houses for a longer period of time. Since 1985, the average time a homeowner owned their home, or their tenure, has increased from 5 to 10 years (See graph below):

This is several years longer than what used to be the historical norm. The side effect, however, is when you stay in one place for so long, you may get even more emotionally attached to your space. If it’s the first home you purchased or the house where your children grew up, it very likely means something extra special to you. Every room has memories, and it’s hard to detach from that sentimental value.

For some homeowners, that connection makes it even harder to separate the emotional value of the house from the fair market price. That’s why you need a real estate professional to help you with the negotiations along the way.

3. Stage Your House Properly

We’re generally quite proud of our décor and how we’ve customized our houses to make them our own unique homes. However, not all buyers will feel the same way about your design and personal touches. That’s why it’s so important to make sure you stage your house with the buyer in mind.

Buyers want to envision themselves in the space so it truly feels like it could be their own. They need to see themselves inside with their furniture and keepsakes – not your pictures and decorations. Stage, clean, and declutter so they can visualize their own dreams as they walk through each room. A real estate professional can help you with tips to get your home ready to stage and sell.

Bottom Line

Today’s sellers’ market might be your best chance to make a move.

If you’re considering selling your house, reach out to a local real estate professional to help you navigate through the process and prioritize these key elements.

Options Are Improving For Homebuyers

- Buyers hoping for more homes to choose from may be in luck as housing inventory begins to rise. Many experts agree – new sellers listing their homes is great news for buyers and the overall market.

- Although the supply increases are modest, more homes means more options for buyers. A rise in inventory may also help slow the price gains we’ve seen recently and could be a sign of good things to come.

- If you’re searching for a home to buy, rising inventory is welcome news.

Reach out to a local real estate professional today to learn about new listings in your area.