-If you’re thinking of buying a home and not sure where to start, you’re not alone.

-Here’s a map with 10 simple steps to follow in the homebuying process.

-Be sure to work with a trusted real estate professional to learn the specific path to take in your local area.

Tag Archives: real estate tips

Why You Need A Real Estate Pro

- A recent study shared by NAR notes that both buyers and sellers think an agent is more helpful than ever during the current health crisis.

- Expertise and professionalism are highly valued and can save buyers and sellers time and effort along the way.

- If you’re thinking of buying or selling a home this year, be sure you have a trusted professional on your side.

Why It’s Important To Have Preapproval

You may have heard that pre-approval is a great first step in the homebuying process. But why is it so important? When looking for a home, the temptation to fall in love with a house that’s outside your budget is very real. So, before you start shopping around, it’s helpful to know your price range, what you’re comfortable within a monthly mortgage payment, and ultimately how much money you can borrow for your loan. Pre-approval from a lender is the only way to do this.

According to a recent survey from realtor.com, many buyers are making the mistake of skipping the pre-approval step in the homebuying process:

“Of over 2,000 active home shoppers who plan to purchase a home in the next 12 months, only 52% obtained a pre-approval letter before beginning their home search, which means nearly half of home buyers are missing this crucial piece of paperwork.”

This paperwork (the pre-approval letter) shows sellers you’re a qualified buyer, something that can really help you stand out from the crowd in the current ultra-competitive market.

How competitive is today’s market? Extremely – especially among buyers.

With limited inventory, there are many more buyers than sellers right now, and that’s fueling the competition. According to the National Association of Realtors (NAR), homes are receiving an average of 2.9 offers for sellers to negotiate, so bidding wars are heating up.

Pre-approval shows homeowners you’re a serious buyer. It helps you stand out from the crowd if you get into a multiple-offer scenario, and these days, it’s likely. When a seller knows you’re qualified to buy the home, you’re in a better position to potentially win the bidding war and land the home of your dreams.

Danielle Hale, Chief Economist for realtor.com notes:

“For ‘a buyer in a competitive market, it’s typically essential to have pre-approval done in order to submit an offer, so getting it done before you even look at homes is a smart move that will enable a buyer to move fast to put an offer in on the right home.’”

In addition, today’s housing market is also changing from moment to moment. Interest rates are low, prices are going up, and lending institutions are regularly updating their standards. You’re going to need guidance to navigate these waters, so it’s important to have a team of professionals (a loan officer and a real estate agent) making sure you take the right steps along the way and can show your qualifications as a buyer at the time you find a home to purchase.

Bottom Line

In a competitive market with low inventory, a pre-approval letter is a game-changing piece of the homebuying process. If you’re ready to buy this year, reach out to a local real estate professional (who can also connect you with a trusted lender) before you start searching for a home.

Do’s and Don’ts after Applying For a Mortgage

Once you’ve found the right home and applied for a mortgage, there are some key things to keep in mind before you close. You’re undoubtedly excited about the opportunity to decorate your new place, but before you make any large purchases, move your money around, or make any major life changes, consult your lender – someone who is qualified to tell you how your financial decisions may impact your home loan.

Below is a list of things you shouldn’t do after applying for a mortgage. They’re all important to know – or simply just good reminders – for the process.

1. Don’t Deposit Cash into Your Bank Accounts Before Speaking with Your Bank or Lender. Lenders need to source your money, and cash is not easily traceable. Before you deposit any amount of cash into your accounts, discuss the proper way to document your transactions with your loan officer.

2. Don’t Make Any Large Purchases Like a New Car or Furniture for Your New Home. New debt comes with new monthly obligations. New obligations create new qualifications. People with new debt have higher debt-to-income ratios. Higher ratios make for riskier loans, and then sometimes qualified borrowers no longer qualify.

3. Don’t Co-Sign Other Loans for Anyone. When you co-sign, you’re obligated. With that obligation comes higher ratios as well. Even if you promise you won’t be the one making the payments, your lender will have to count the payments against you.

4. Don’t Change Bank Accounts. Remember, lenders need to source and track your assets. That task is significantly easier when there’s consistency among your accounts. Before you transfer any money, speak with your loan officer.

5. Don’t Apply for New Credit. It doesn’t matter whether it’s a new credit card or a new car. When you have your credit report run by organizations in multiple financial channels (mortgage, credit card, auto, etc.), your FICO® score will be impacted. Lower credit scores can determine your interest rate and maybe even your eligibility for approval.

6. Don’t Close Any Credit Accounts. Many buyers believe having less available credit makes them less risky and more likely to be approved. Wrong. A major component of your score is your length and depth of credit history (as opposed to just your payment history) and your total usage of credit as a percentage of available credit. Closing accounts has a negative impact on both of those determinants of your score.

Bottom Line

Any blip in income, assets, or credit should be reviewed and executed in a way that ensures your home loan can still be approved. If your job or employment status has changed recently, share that with your lender as well. The best plan is to fully disclose and discuss your intentions with your loan officer before you do anything financial in nature.

Reasons to Hire a Real Estate Professional

*Choosing the right real estate professional to work with is one of the most important decisions you can make in your homebuying or selling process.

*The right agent can explain current market conditions and break down exactly what they mean for you.

*If you’re considering buying or selling a home this year, make sure to work with someone who has the experience to answer all of your questions about pricing, contracts, negotiations, and more.

Terms to Know in Homebuying Process

Some Highlights

*Buying a home can be intimidating if you’re not familiar with the terms used throughout the process.

*To point you in the right direction, here’s a list of some of the most common language you’ll hear along the way.

*The best way to ensure your homebuying process is a positive one is to find a real estate professional who will guide you through every aspect of the transaction with ‘the heart of a teacher’ by putting your needs first.

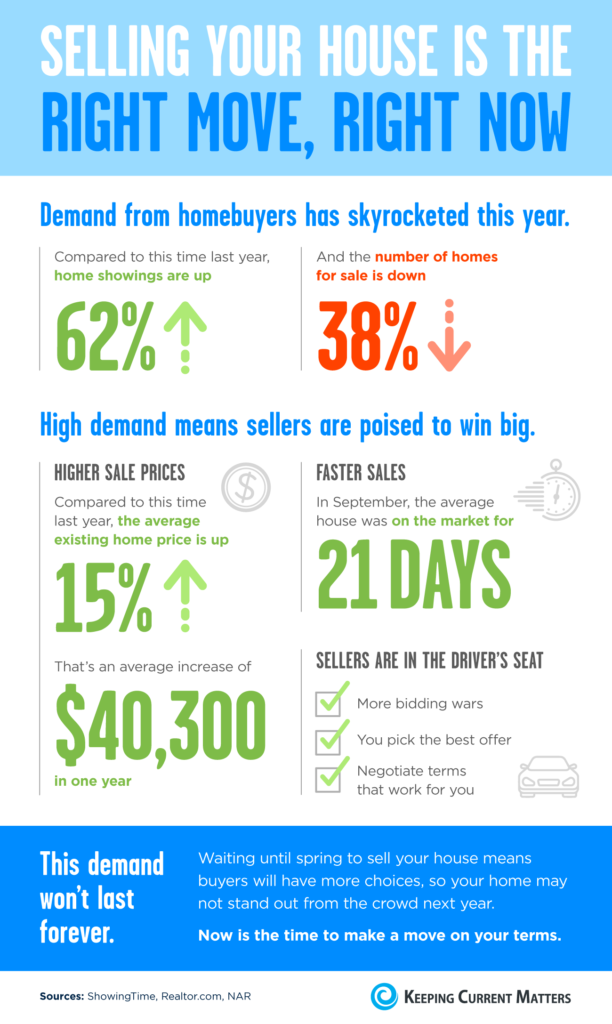

Selling Your House is The Right Move NOW

Some Highlights

Demand from homebuyers has skyrocketed this year, which means today’s sellers are poised to win big. This ideal moment in time to sell your house won’t last forever, though.

With more sellers coming to the market in the spring, waiting until next year means buyers will have more choices, so your home may not stand out from the crowd.

Reach out to a local real estate professional today to discuss why now may be the right time to make a move on your terms.

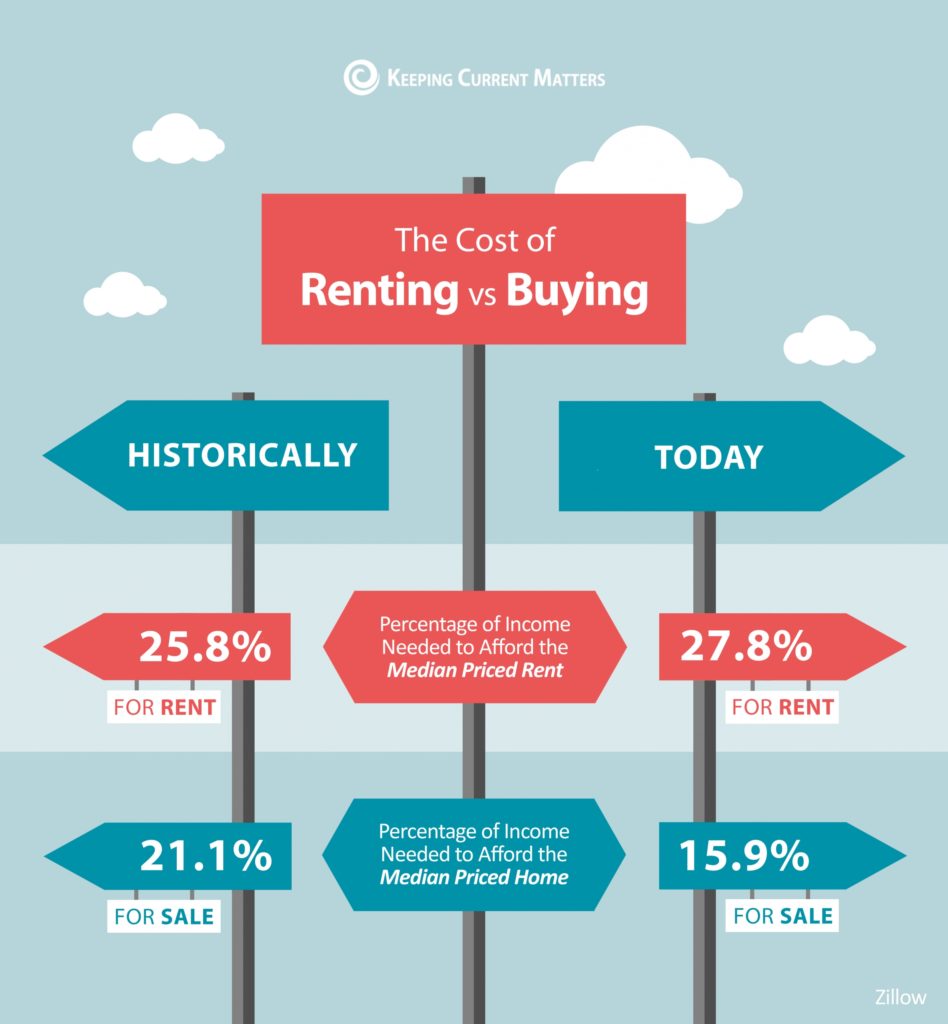

The Cost of Renting vs Buying

Some Highlights

- The percentage of income needed to afford a median-priced home today is declining, while that for renting is on the rise.

- This is making buying a home an increasingly attractive option for many people, especially with low mortgage rates driving purchasing power.

- If you’d like expert guidance on exploring your home buying options while affordability is high, reach out to a local real estate professional.

Why pre-approval is the first step in buying a home

When the number of buyers in the housing market outnumbers the number of homes for sale, it’s called a “seller’s market.” The advantage tips toward the seller as low inventory heats up the competition among those searching for a place to call their own. This can create multiple offer scenarios and bidding wars, making it tough for buyers to land their dream homes – unless they stand out from the crowd. Here are three reasons why pre-approval should be your first step in the homebuying process.

1. Gain a Competitive Advantage

Low inventory, like we have today, means homebuyers need every advantage they can get to make a strong impression and close the deal. One of the best ways to get one step ahead of other buyers is to get pre-approved for a mortgage before you make an offer. For one, it shows the sellers you’re serious about buying a home, which is always a plus in your corner.

2. Accelerate the Homebuying Process

Pre-approval can also speed up the homebuying process, so you can move faster when you’re ready to make an offer. In a competitive arena like we have today, being ready to put your best foot forward when the time comes may be the leg-up you need to cross the finish line first and land the home of your dreams.

3. Know What You Can Borrow and Afford

Here’s the other thing: if you’re pre-approved, you also have a better sense of your budget, what you can afford, and ultimately how much you’re eligible to borrow for your mortgage. This way, you’re less apt to fall in love with a home that may be out of your reach.

Freddie Mac sets out the advantages of pre-approval in the My Home section of their website:

“It’s highly recommended that you work with your lender to get pre-approved before you begin house hunting. Pre-approval will tell you how much home you can afford and can help you move faster, and with greater confidence, in competitive markets.”

Local real estate professionals also have relationships with lenders who can help you through this process, so partnering with a trusted advisor will be key for that introduction. Once you select a lender, you’ll need to fill out their loan application and provide them with important information regarding “your credit, debt, work history, down payment and residential history.”

Freddie Mac also describes the ‘4 Cs’ that help determine the amount you’ll be qualified to borrow:

- Capacity: Your current and future ability to make your payments

- Capital or Cash Reserves: The money, savings, and investments you have that can be sold quickly for cash

- Collateral: The home, or type of home, that you would like to purchase

- Credit: Your history of paying bills and other debts on time

While there are still many additional steps you’ll need to take in the homebuying process, it’s clear why pre-approval is always the best place to begin. It’s your chance to gain the competitive edge you may need if you’re serious about owning a home.

Bottom Line

Getting started with pre-approval is a great way to begin the homebuying journey. Reach out to a local real estate professional today to make sure you’re on the fastest path to homeownership.

Make the Dream of Homeownership a Reality in 2020

Make the Dream of Homeownership a Reality in 2020

In 1963, Martin Luther King, Jr. led and inspired a powerful movement with his famous “I Have a Dream” speech. Through his passion and determination, he sparked interest, ambition, and courage in his audience. Today, reflecting on his message encourages many of us to think about our own dreams, goals, beliefs, and aspirations. For many Americans, one of those common goals is owning a home: a piece of land, a roof over our heads, and a place where our families can grow and flourish.

If you’re dreaming of buying a home this year, the best way to start the process is to connect with a Real Estate professional to understand what goes into buying a home. Once you have that covered, then you can answer the questions below to make the best decision for you and your family.

1. How Can I Better Understand the Process, and How Much Can I Afford?

The process of buying a home is not one to enter into lightly. You need to decide on key things like how long you plan on living in an area, school districts you prefer, what kind of commute works for you, and how much you can afford to spend.

Keep in mind, before you start the process to purchase a home, you’ll also need to apply for a mortgage. Lenders will evaluate several factors connected to your financial track record, one of which is your credit history. They’ll want to see how well you’ve been able to minimize past debts, so make sure you’ve been paying your student loans, credit cards, and car loans on time. Most agents have loan officers they trust that they can refer you to.

According to ConsumerReports.org,

“Financial planners recommend limiting the amount you spend on housing to 25 percent of your monthly budget.”

2. How Much Do I Need for a Down Payment?

In addition to knowing how much you can afford on a monthly mortgage payment, understanding how much you’ll need for a down payment is another critical step. Thankfully, there are many different options and resources in the market to potentially reduce the amount you may think you need to put down up front.

If you’re concerned about saving for a down payment, start small and be consistent. A little bit each month goes a long way. Jumpstart your savings by automatically adding a portion of your monthly paycheck into a separate savings account or house fund. AmericaSaves.org says,

“Over time, these automatic deposits add up. For example, $50 a month accumulates to $600 a year and $3,000 after five years, plus interest that has compounded.”

Before you know it, you’ll have enough for a down payment if you’re disciplined and thoughtful about your process.

3. Saving Takes Time: Practice Living on a Budget

As tempting as it is to settle in each morning with a fancy cup of coffee from your favorite local shop, putting that daily spend toward your down payment will help accelerate your path to homeownership. It’s the little things that count, so start trying to live on a slightly tighter budget if you aren’t doing so already. A budget will allow you to save more for your down payment and help you pay down other debts to improve your credit score. A survey of Millennial spending shows,

“70 percent of would-be first-time homebuyers will cut spending on spa days, shopping and going to the movies in exchange for purchasing a home within the next year.”

While you don’t need to cut all of the fun out of your current lifestyle, making smarter choices and limiting your spending in areas where you can slim down will make a big difference.

Bottom Line

If homeownership is on your dream list this year, take a good look at what you can prioritize to help you get there. To determine the steps you should take to start the process, meet with a local real estate professional today.