The housing market has been scorching hot over the last twelve months. Buyers and their high demand have far outnumbered sellers and a short supply of houses. According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), sales are up 23.7% from the same time last year while the inventory of homes available for sale is down 25.7%. There are 360,000 fewer single-family homes for sale today than there were at this time last year. This increase in demand coupled with such limited supply is leading to more bidding wars throughout the country.

Rose Quint, Assistant Vice President for Survey Research with the National Association of Home Builders (NAHB), recently reported:

“The number one reason long-time searchers haven’t made a home purchase is not because of their inability to find an affordably-priced home, but because they continue to get outbid by other offers.”

A survey in the NAHB report showed that 40% of buyers have been outbid for a home they wanted to purchase. This is more than twice the percentage in 2019, which was 19%.

What does this mean for sellers today?

It means sellers have tremendous leverage when negotiating with buyers.

In negotiations, leverage is the power that one side may have to influence the other side while moving closer to their negotiating position. A party’s leverage is based on its ability to award benefits or eliminate costs on the other side.

In today’s market, a buyer wants three things:

- To buy a home

- To buy now before prices continue to appreciate

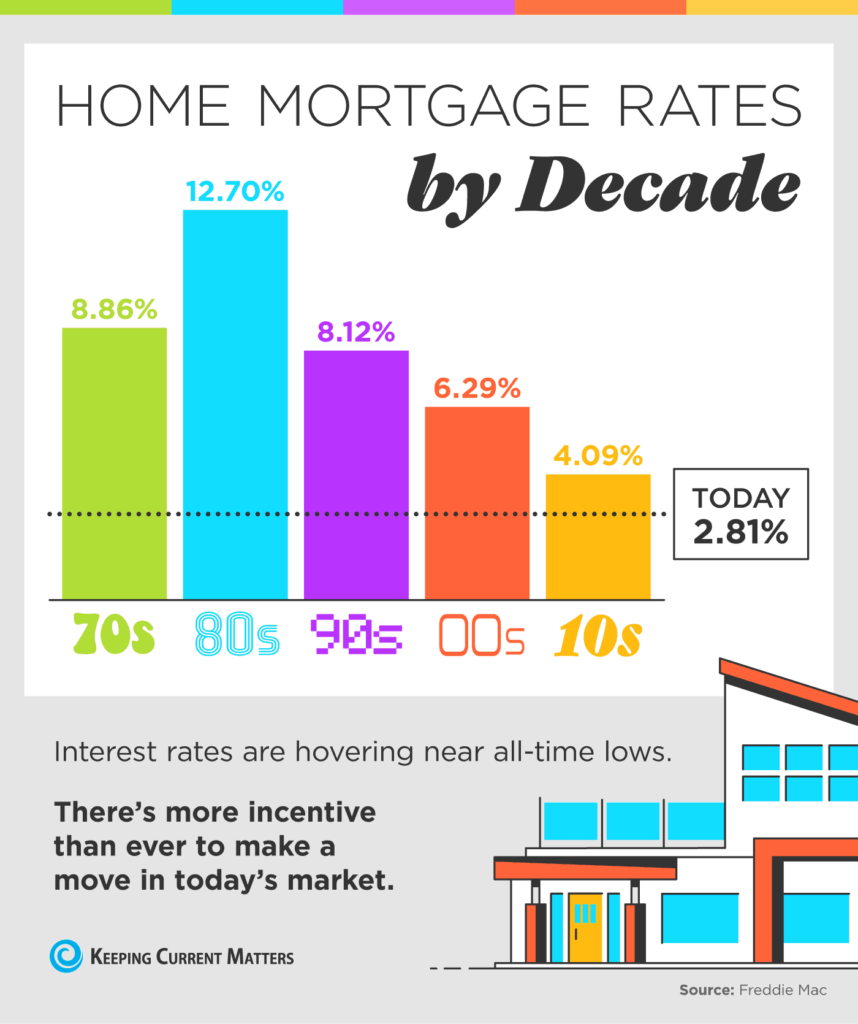

- To buy now and take advantage of historically low mortgage rates while they last

These three buyer needs give the homeowner tremendous leverage when selling their house. Most realize this leverage enables the seller to sell at a good price. However, there may be another need the seller has that can be satisfied by using this leverage.

Here’s an example:

Odeta Kushi, Deputy Chief Economist at First American, recently identified a situation in which many sellers are finding themselves today:

“As mortgage rates are expected to remain near 3%, millennials continue to form households and more existing homeowners tap their equity for the purchase of a better home…Many homeowners may want to upgrade, but do not for fear that they will be unable to find a home to buy.”

She then offers a possible solution:

“While the fear of not being able to find something to buy will not disappear in a limited supply environment, new housing supply can incentivize existing homeowners to move.”

There’s no doubt many sellers would love to build a new home to perfectly fit their changing wants and needs. However, most builders require that they sell their house first. If the seller sells their home, where would they live while their new home is being constructed?

Going back to the concept of leverage:

As mentioned, buyers have compelling reasons to purchase a home now, and many homeowners have challenges to address if they want to sell. Perhaps they can make a deal to satisfy each party’s needs. But how?

The seller may decide to sell their home to the buyer at today’s price, which will enable the purchaser to take advantage of current mortgage rates. In return, the buyer might lease the house back to the seller for a pre-determined length of time while the seller’s new home is being built. A true win-win negotiation.

Not every buyer will agree to such a deal – but you only need one.

That’s just one example of how a seller might be able to overcome a challenge because of the leverage they have in today’s market. Maybe you feel a need to make certain repairs before selling. Perhaps you need time to get permits or approvals for certain upgrades you made to the house. Whatever the challenge, you may be able to work it out.

Bottom Line

If you’re considering selling your house now but worry a huge obstacle stands in your way, contact a local real estate professional.

Maybe with the leverage you currently have, you can negotiate a deal that will allow you to make the move of your dreams.

source