-

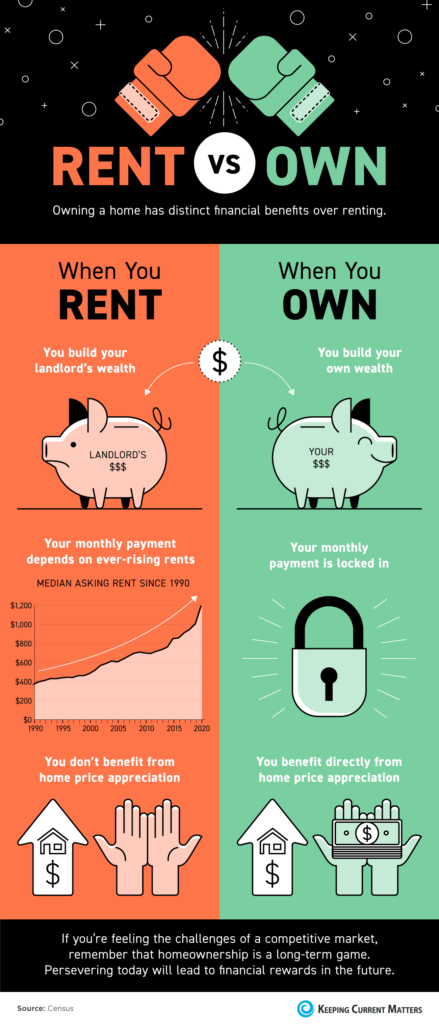

- When you rent, you build your landlord’s wealth, your monthly payment depends on ever-rising rents, and you don’t benefit from home price appreciation.

- On the other hand, when you own your home, you build your own wealth, your monthly payment is locked in, and you benefit directly from home price appreciation.

- If you’re feeling the challenges of a competitive market, remember that homeownership is a long-term game. Persevering today will lead to financial rewards in the future.

- Make sure to reach out to a real estate professional to assist you with your decision to buy or rent.

Tag Archives: benefits of owning a home

Nonfinancial Benefits of Owning A Home

Homeownership is a foundational part of the American Dream. As we look back on more than a year of sheltering in our homes, having a place of our own is more important than ever. While financial benefits are always a key aspect of homeownership, today, homeowners rank the nonfinancial and personal benefits with even higher value.

Recently, two national surveys revealed the reasons homeownership is such an important part of life. The top three personal benefits of homeownership noted by respondents in Unison’s 2021 report on The State of the American Homeowner are:

- 91% – feel secure, stable, or successful owning a home

- 70% – feel emotionally attached to the homes that have kept them safe over the past year

- 51% – call homeownership a “key part of their life”

These sentiments were supported by the most recent National Housing Survey from Fannie Mae, which also shows that the top three reasons Americans value homeownership have nothing to do with money. Those surveyed were given a list of feelings and accomplishments that are associated with or impacted by where we live. They were then asked, “To achieve this, are you better off owning or better off renting?” Here are the top three points from the list that respondents said homeownership could help them achieve:

- 91% – control over what you do with your living space

- 90% – a sense of privacy and security

- 89% – a good place for your family to raise your children

Other nonfinancial advantages of homeownership revealed by the survey include feeling engaged in a community, having flexibility in future decisions, and experiencing less stress.

Bottom Line

Financial and nonfinancial benefits are a key component to the value of homeownership, but the nonfinancial side is most valued after a year full of pandemic-driven challenges.

Contact a real estate professional today if you’re ready to take the first steps toward becoming a homeowner.

Homeownership is Full of Financial Benefits

A Fannie Mae survey recently revealed some of the most highly-rated benefits of homeownership, which continue to be key drivers in today’s power-packed housing market. Here are the top four financial benefits of owning a home according to consumer respondents:

- 88% – a better chance of saving for retirement

- 87% – the best investment plan

- 85% – the chance to be better off financially

- 85% – the chance to build up wealth

Additional financial advantages of homeownership included in the survey are having the best overall tax situation and being able to live within your budget.

Does homeownership actually give you a better chance to build wealth?

No one can question a person’s unique feelings about the importance of homeownership. However, it’s fair to ask if the numbers justify homeownership as a financial asset.

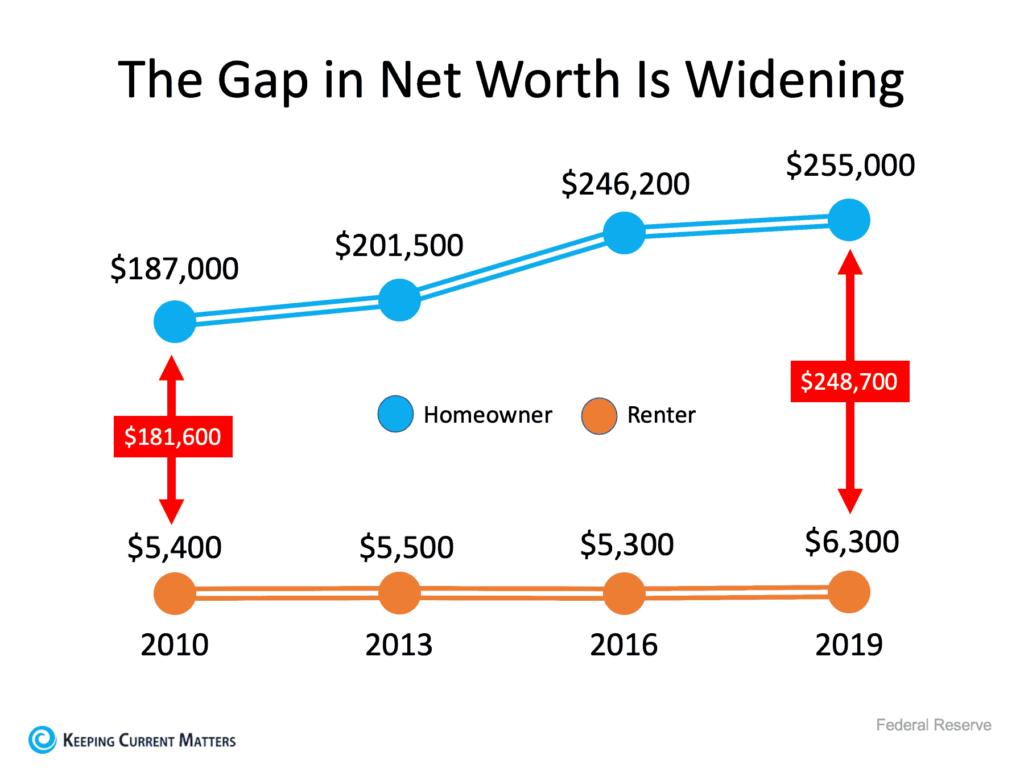

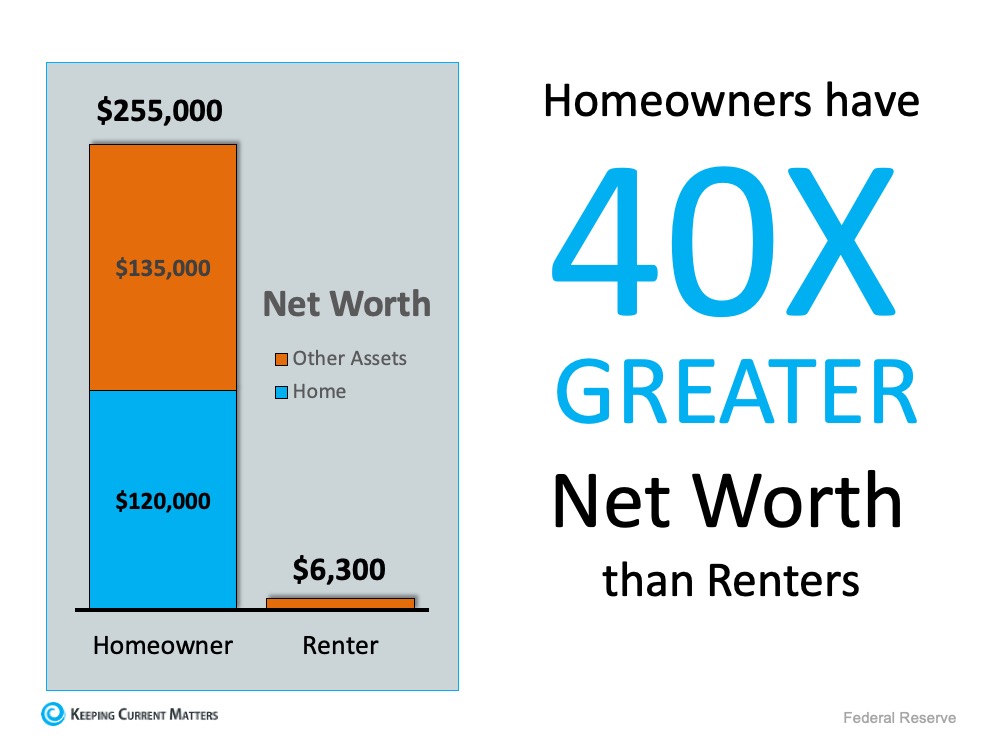

Last fall, the Federal Reserve released the Survey of Consumer Finances, a report done every three years, with the latest edition covering through 2019. Their findings confirmed that homeownership is a clear financial benefit. The survey found that homeowners have forty times higher net worth than renters ($255,000 for homeowners compared to $6,300 for renters).

The difference in net worth between homeowners and renters has continued to grow. Here’s a graph showing the results of the last four Fed surveys:

The above graph only includes data through 2019, but according to CoreLogic, the equity held by homeowners grew by $26,300 over the last twelve months alone. That means the gap between the net worth of homeowners and renters has probably widened even further over the last year.

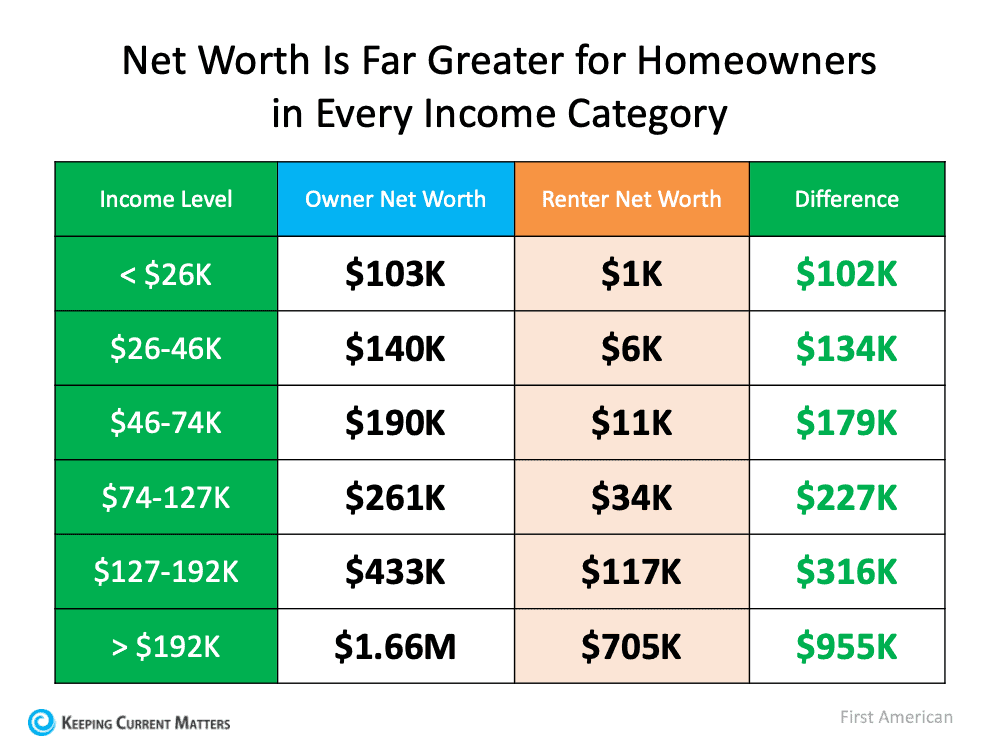

Some might argue the difference in net worth may be due to homeowners normally having larger incomes than renters and therefore the ability to save more money. However, a study by First American shows homeowners have greater net worth than renters regardless of their income level. Here are the findings:

Others may think homeowners are older and that’s why they have a greater net worth. However, a Joint Center for Housing Studies of Harvard University report on homeowners and renters over the age of 65 reveals:

“The ability to build equity puts homeowners far ahead of renters in terms of household wealth…the median owner age 65 and over had home equity of $143,500 and net wealth of $319,200. By comparison, the net wealth of the same-age renter was just $6,700.”

Homeowners 65 and older have 47.6 times greater net worth than renters.

Bottom Line

The idea of homeownership as a direct way to build your net worth has met the test of time.

Contact a local real estate professional if you’re ready to take steps toward becoming a homeowner.

3 Ways Home Equity Can Impact Your Life

There have been a lot of headlines reporting on how homeowner equity (the difference between the current market value of your home and the amount you owe on your mortgage) has dramatically increased over the past few years. CoreLogic indicated that equity increased for the average homeowner by $17,000 in the last year alone. ATTOM Data Solutions, in their latest U.S. Home Equity Report, revealed that 30.2% of the 59 million mortgaged homes in the United States have at least 50% equity. That doesn’t even include the 38% of homes that are owned free and clear, meaning they don’t have a mortgage at all.

How can equity help a household?

Having equity in your home can dramatically impact your life. Equity is like a savings account you can tap into when you need cash. Like any other savings, you should be sensible in how you use it, though. Here are three good reasons to consider using your equity.

1. You’re experiencing financial hardship (job loss, medical expenses, etc.)

Equity gives you options during difficult financial times. With equity, you could refinance your house to get cash which may ease the burden. It also puts you in a better position to talk to the bank about restructuring your home loan until you can get back on your feet.

Today, there are 2.7 million Americans who are currently in a forbearance program because of the pandemic. Ninety percent of those in the program have at least 10% equity. That puts them in a better position to get a loan modification instead of facing foreclosure because many banks will see the equity as a form of collateral in a new deal. If you’re in this position, even if you can’t get a modification, the equity allows you the option to sell your house and walk away with your equity instead of losing the house and your investment in it.

2. You need money to start a new business

We’ve all heard the stories about how many great American companies started in the founder’s garage (i.e., Disney, Hewlett Packard, Apple, Yankee Candle, Keeping Current Matters). What we might not realize, however, is the garage (along with the rest of the home) supplied the start-up money for many of these companies in the form of a refinance.

If you’re passionate about an idea you have for a new product or service, the equity in your home may enable you to make that dream a reality.

3. You want to invest in a loved one’s future

It’s been a long-standing tradition in this country for many households to help pay college expenses for their children. Some have tapped into the equity in their homes to do that.

Additionally, George Ratiu, Senior Economist for realtor.com, notes:

“52% of Americans who bought their first home in 2020 said they got help with their down payment from friends or family. The number one lender? Their parents.”

It’s safe to assume a percentage of that down payment money likely came from home equity.

Bottom Line

Savings in any form is a good thing. The forced savings you can earn from making a mortgage payment enables you to build wealth through home equity. That equity can come in handy in both good and more challenging times.

When you’re ready, contact your local real estate professional to help you find and purchase the ideal home for you.

Why Its Easy To Fall In Love With Homeownership

Some Highlights

- Homeownership provides comfort, stability, and security, and it makes you feel more connected to your community.

- Your home is something to be proud of and is uniquely yours, so you can customize it to your heart’s desire.

- If you’re ready to fall in love with a home of your own, contact a local real estate professional to get you started on the path to homeownership.

6 Benefits of Owning Your Home

Over the past year, our homes have become an integral part of our lives more than ever. They’re much more than the houses we live in. They’re our workplaces, virtual schools, and safe havens that provide shelter, stability, and protection through the evolving health crisis. Today, 65.8% of Americans are fortunate enough to call their homes their own.

As we continue to think about the future, our goals for the year, and what we want to achieve well beyond 2021, it’s a great time to look at the benefits of owning a home. Below are some highlights and quotes on the benefits of homeownership shared by the National Association of Realtors (NAR). From feel-good motivations to economic and social impacts on the local community, these items may give you reason to believe homeownership stretches well beyond your financial investment.

Non-Financial Benefits

Owning a home brings a sense of happiness, satisfaction, and pride.

- Pride of Ownership: It feels good to have a place that’s truly your own, especially since you can customize it to your liking. “The personal satisfaction and sense of accomplishment achieved through homeownership can enhance psychological health, happiness and well-being for homeowners and those around them.”

- Civic Participation: Homeownership creates stability, a sense of community, and increases civic engagement. It’s a way to add to the strength of your local area and drive value into your neighborhood.

Financial Benefits

Buying a home is also an investment in your financial future.

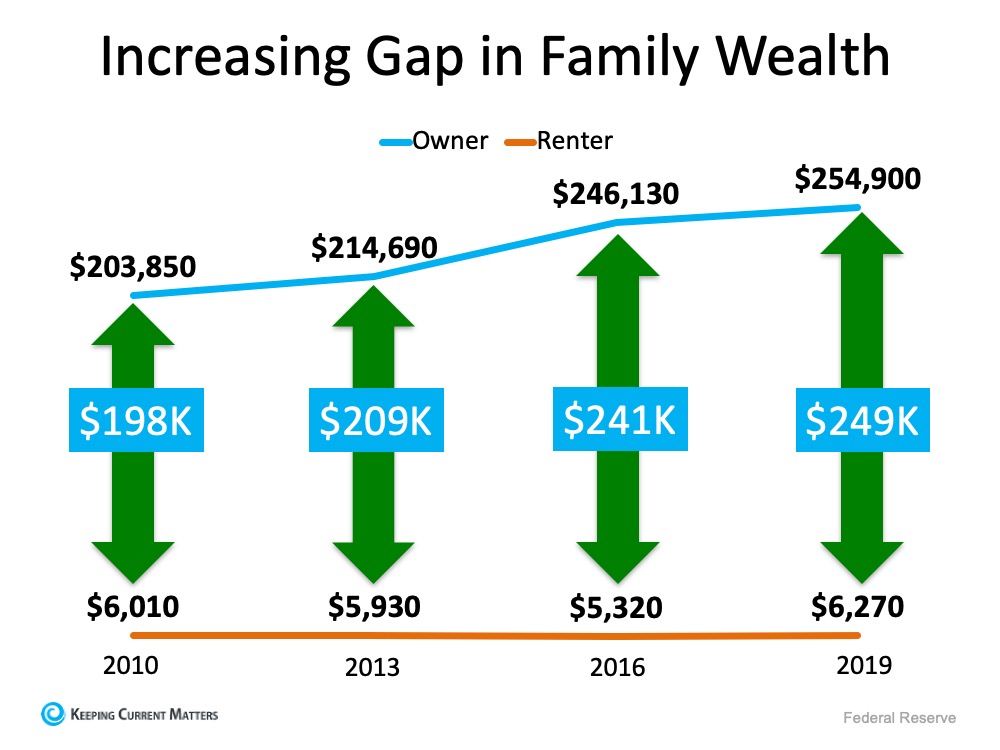

- Net Worth: Homeownership builds your net worth. Today, the median household net worth of all homeowners is $254,900, while the median net worth of renters is only $6,270.

- Financial Security: Equity, appreciation, and more predictable monthly housing expenses are huge financial benefits of owning a home. Homeownership is truly the best way to improve your long-term financial position.

Economic Benefits

Homeownership is even a local economic driver.

- Housing-Related Spending: An economic force throughout our nation, housing-related expenses accounted for more than one-sixth of the country’s economic activity over the past three decades.

- Entrepreneurship: Homeownership is also a form of forced savings that can provide entrepreneurial opportunities. “Owning a home enables new entrepreneurs to obtain access to credit to start or expand a business and generate new jobs by using their home as collateral for small business loans.”

Bottom Line

The benefits of homeownership go well beyond the basics. Homeownership is truly a way to build financial freedom, find greater satisfaction and happiness, and make a substantial impact in your community. If owning a home is part of your dream this year, contact a local real estate professional to begin the home buying process today.

Why Owning A Home is a Powerful Financial Decision

In today’s housing market, there are clear financial benefits to owning a home: increasing equity, the chance to build your net worth, and appreciating home values, just to name a few. If you’re a renter, it’s never too early to think about how homeownership can propel you toward a stronger future. Here’s a dive into three often-overlooked financial benefits of homeownership and how preparing for them now can steer you in the direction of greater financial security and savings.

1. You Won’t Always Have a Monthly Housing Payment

Personal finance advisor Dave Ramsey explains:

“Every payment brings you closer to owning the house. When you pay your rent, that money is spent. Gone. Bye. Not returning. But when you pay your mortgage, you work toward full ownership.”

As a homeowner, you can eventually eliminate the monthly payment you make on your house. That’s a huge win and a big factor in how homeownership can drive stability and savings in your life. As soon as you buy a home, your monthly housing costs begin to work for you as forced savings in the form of equity. When you build equity and grow your net worth, you can continue to reinvest those savings into your future, maybe even by buying that next dream home. The possibilities are truly endless.

2. Homeownership Is a Tax Break

One thing people who have never owned a home don’t always think about are the tax advantages of homeownership. The same article states:

“You have tax advantages. Many of the costs of owning a home—like property taxes—are tax deductible. And if you’re paying off a mortgage, you’ll get to count your mortgage interest as a deduction when you file your tax return.”

Whether you’re living in your first home or your fifth, it’s a huge financial advantage to have some tax relief tied to the interest you pay each year. It’s one thing you definitely don’t get when you’re renting. Be sure to work with a tax professional to get the best possible benefits on your annual return.

3. Monthly Housing Costs Are Predictable

A third benefit is the fact that monthly costs start to become more predictable with homeownership, something that doesn’t happen if you’re renting. Ramsey also notes:

“Rent rates will go up. Even if you found a killer deal in a hot area, inflation, competition, and rising property values will cause your rent to go up year after year.”

With a mortgage, you can keep your monthly housing costs relatively steady and predictable. Your monthly costs are most likely based on a fixed-rate mortgage, which allows you to budget your finances over a longer period of time. Rental prices have been skyrocketing since 2012, and with today’s low mortgage rates, it’s a great time to get more for your money when purchasing a home. If you want to lock-in your monthly payment at a low rate and have a solid understanding of what you’re going to spend in your mortgage payment each month, buying a home may be your best bet.

Bottom Line

If you’re ready to start feeling the benefits of stability, savings, and predictability that come with owning a home, reach out to a local real estate professional to determine if buying sooner rather than later is right for you.

Homeowners Net Worth is 40x Greater Than A Renters Net Worth

One of the best ways to build your family’s financial future is through homeownership. Recent data from the Federal Reserve indicates the net worth of a homeowner is actually over 40 times greater than that of a renter. Maybe it’s time to start thinking about buying a home, especially when they’re so affordable in today’s market.

Every three years the Survey of Consumer Finances shows the breakdown of how owning a home helps build financial security. In the graph below, we see that the average net worth of homeowners continues to grow, while the net worth of renters tends to hold fairly steady and be significantly lower than that of homeowners. The gap between owning and renting just keeps getting wider over time, making homeownership more and more desirable for those who are ready.

Owning a home is a great way to build family wealth.

For many families, homeownership serves as a form of ‘forced savings.’ Every time you pay your mortgage, you’re contributing to your net worth by increasing the equity you have in your home (See chart below): The impact of home equity is part of why Gallup reports that Americans picked real estate as the best long-term investment for the seventh year in a row. According to this year’s survey, 35% of Americans chose real estate over stocks, savings accounts, gold, and bonds.

The impact of home equity is part of why Gallup reports that Americans picked real estate as the best long-term investment for the seventh year in a row. According to this year’s survey, 35% of Americans chose real estate over stocks, savings accounts, gold, and bonds.

Today, there are great opportunities available for those planning to buy a home. The housing market has made a full recovery, and all-time low interest rates are giving homebuyers a big boost in purchasing power. If you’re ready, buying a home this fall can set you up to increase your net worth and create a safety net for your family’s future.

Bottom Line

To learn how you can use your monthly housing cost to build your family’s net worth, reach out to a trusted real estate professional in your area who can guide you through the homebuying process.

Homeowners are happy, renters not so much!

When people talk about homeownership and the American Dream, much of the conversation revolves around the financial benefits of owning a home. However, two recent studies show that the non-financial benefits might be even more valuable.

In a recent survey, Bank of America asked homeowners: “Does owning a home make you happier than renting?” 93% of the respondents answered yes, while only 7% said no. The survey also revealed:

- More than 80% said they wouldn’t go back to renting

- 88% agreed that buying a home is the “best decision they have ever made”

- 79% believed owning a home has changed them for the better

Those surveyed talked about the “emotional equity” that is built through homeownership. The study says more than half of current homeowners define a home as a place to make memories, compared to 42% who view a home as a financial investment. Besides building wealth, the survey also showed that homeownership enhances quality of life:

- 67% of current homeowners believed their relationships with family and loved ones have changed for the better since they bought a home

- 78% are satisfied with the quality of their social life

- 82% of homeowners said they were satisfied with the amount of time they spend on their hobbies and passions since purchasing a home

- 75% of homeowners pursued new hobbies after buying a home

Homeowners seem to be very happy.

Renters Tell a Different Story…

According to the latest Zillow Housing Aspirations Report, 45% of renters regret renting rather than buying — more than five times the share of homeowners (8%) who regret buying instead of renting. Here are the four major reasons people regret renting, according to the report:

- 52% regret not being able to build equity

- 52% regret not being able to customize or improve their rentals

- 50% regret that the rent is so high

- 49% regret that they lack private outdoor space

These two studies prove that renting is just not the same as owning.

Bottom Line

There are both financial and non-financial benefits to homeownership. As good as the “financial equity” is, it doesn’t compare to the “emotional equity” gained through owning your own home.

Speak to a real estate professional to see what’s best for you and your goals.

The Cost of Not Owning Your Home

There are great advantages to owning a home, yet many people continue to rent. The financial benefits are just some of the reasons why home ownership has been a part of the long-standing American dream.

Realtor.com reported that:

“Buying remains the more attractive option in the long term – that remains the American dream, and it’s true in many markets where renting has become really the shortsighted option…as people get more savings in their pockets, buying becomes the better option.”

Why is owning a home financially better than renting?

Here are the top 5 financial benefits of home ownership:

- Home ownership is a form of forced savings.

- Home ownership provides tax savings.

- Home ownership allows you to lock in your monthly housing cost.

- Buying a home is less expensive than renting.

- No other investment lets you live inside of it.

Studies have also shown that a homeowner’s net worth is 44x greater than that of a renter.

A family that purchased a median-priced home at the start of 2019 would build more than

$37,750 in family wealth over the next five years with projected price appreciation alone.

Some argue that renting eliminates the cost of taxes and home repairs, but every potential renter must realize that all the expenses the landlord incurs are already baked into the rent payment – along with a profit margin!

Bottom Line

Owning a home has many social and financial benefits that cannot be achieved by renting. Reach out to a Real Estate Professional to determine if buying a home is your best move.