A new trend has begun to emerge. With home prices skyrocketing in the starter home category, many first-time homebuyers are skipping the traditional starter homes and moving right into their dream homes.

What’s a Starter Home?

According to the National Association of Realtors (NAR), simply put, a starter home is a one or two-bedroom home (sometimes even a small, three bedroom). “Prices vary widely by market but starters on average cost $150,000 to $250,000 while trade-up and premium homes cost upwards of $300,000.”

Finding Their Forever Homes Now

A recent CNBC article revealed that there are many factors that delayed older millennials (ages 25-35) from buying a home earlier in their lives. The aftereffects of the Great Recession teaming up with larger education costs forced many to either remain living in their parent’s homes or to rent.

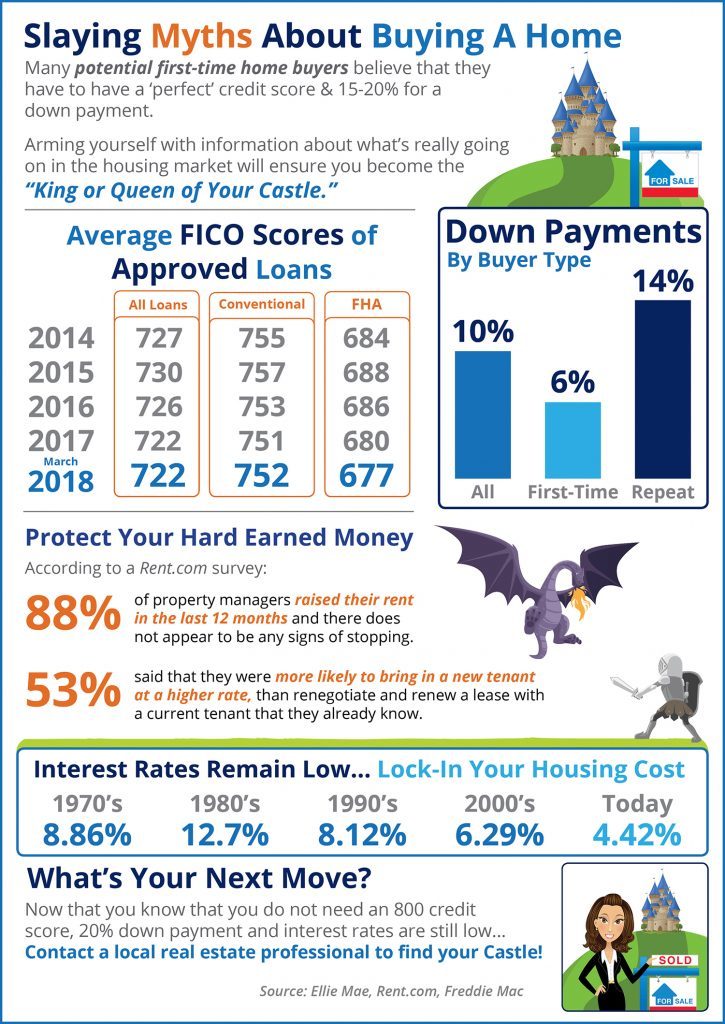

With the economy continuing to improve, many millennials have been able to break into better-paying jobs which has helped spur down payment savings. As the dream of homeownership comes closer to reality, many millennials are saving for their forever homes.

According to the latest statistics from NAR, 30% of millennials bought homes for $300,000 or more this year (up from 14% in 2013). Diane Swonk, Chief Economist at Grant Thornton weighed in saying, “They rented for longer. Now they’re going to where they want to stay.”

More and more millennials are settling down, getting married, and starting families, which is a huge factor driving them to look for larger homes.

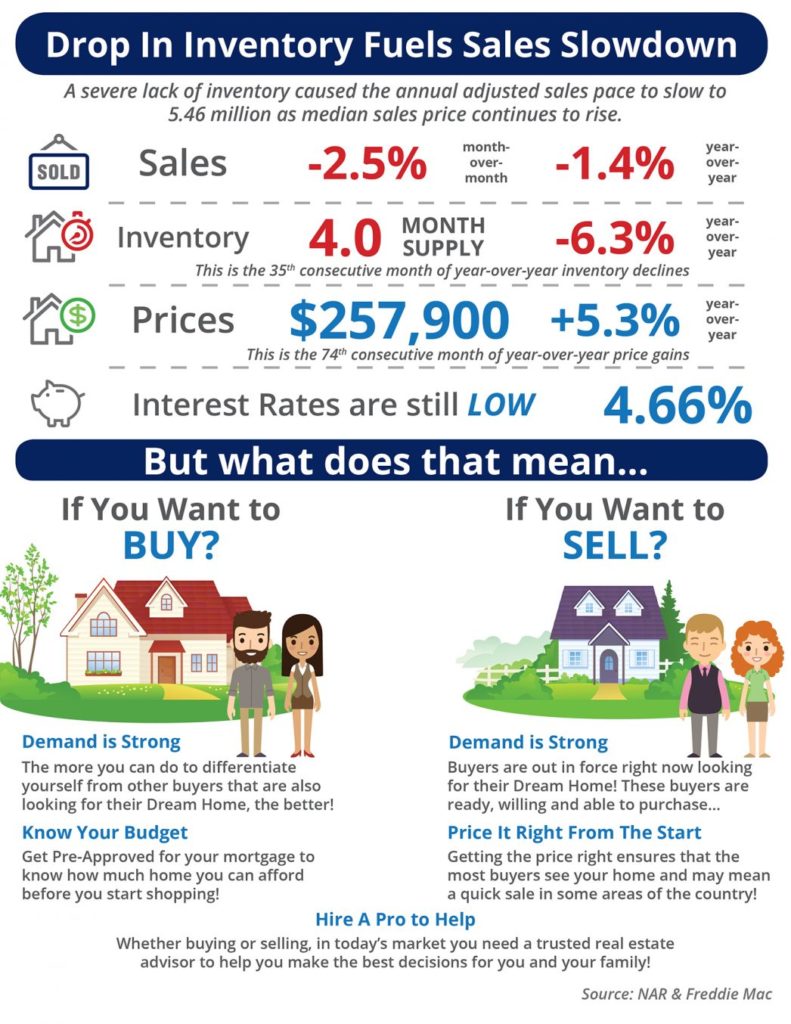

Increased competition in the starter home market has also been a driving force in waiting to afford their dream homes. Inventory in the starter home market is down 14.2% from last year, according to research from Trulia. This has driven prices up and has led to bidding wars.

Many first-time buyers who were originally looking for starter homes are realizing that for just a little bit more of an investment, they could afford trade-up or premium homes instead.

If you plan on purchasing your first home this year, let’s get together to determine how much house you can afford. You may be pleasantly surprised.

Contact Tara Burner