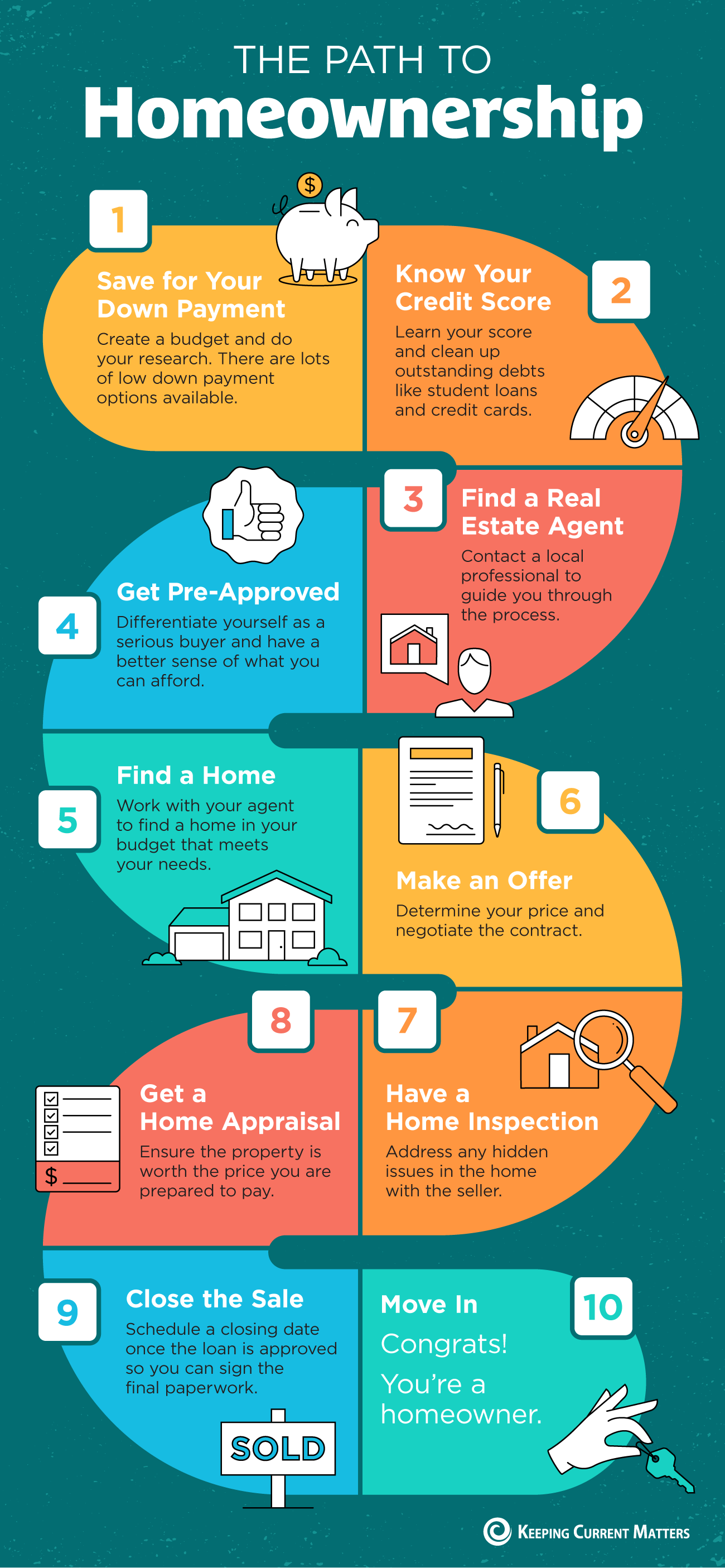

-If you’re thinking of buying a home and not sure where to start, you’re not alone.

-Here’s a map with 10 simple steps to follow in the homebuying process.

-Be sure to work with a trusted real estate professional to learn the specific path to take in your local area.

Category Archives: Buying

Four Reasons People Are Buying Homes in 2021

According to many experts, the real estate market is expected to continue growing in 2021, and it’s largely driven by the lasting impact the pandemic is having on our lifestyles. As many of us spend extra time at home, we’re reevaluating what “home” means and what we may need in one going forward.

Here are 4 reasons people are reconsidering where they live and why they’re expecting to buy a home this year.

1. Record-Low Mortgage Interest Rates

In 2020, the average interest rate for a 30-year fixed mortgage hit a record low 16 times, continuing to fall further below 3%. According to Freddie Mac, the average 30-year fixed interest rate today is 2.65%. Many wonder how low these rates will go and how long they’ll last. Len Keifer, Deputy Chief Economist for Freddie Mac, advises:

“If you’ve found a home that fits your needs at a price you can afford, it might be better to act now rather than wait for future rate declines that may never come and a future that likely holds very tight inventory.”

This sense of urgency is driving many to buy this year.

2. Working from Home

Remote work is a new normal for many businesses, and it’s lasting longer than most expected. Many in the workforce today are discovering they don’t need to live close to the office anymore and they can get more for their money by moving a little further outside of the city limits. David Mele, President at Homes.com, says:

“The surge in the work-from-home population has rewritten the playbook for many homebuying and rental decisions, from when and where to relocate, to what people are looking for in their next residence.”

The reality is, for some people, working remotely in their current home is challenging, especially when there may be other options available.

3. More Outdoor Space

Another new priority for homeowners is having more usable outdoor space. Being at home is driving those in some areas to seek less densely populated neighborhoods so they have more room to stretch their legs. In addition, those living in apartments and townhomes are often looking for extra square footage, both inside and out.

According to the State of Home Spending report by HomeAdvisor, of the households surveyed, almost half reported spending 27% more on outdoor living over the past year. This is a trend that’s expected to grow in 2021 and beyond.

4. Avoiding Renovations

It’s recently come to light that many homeowners would also rather buy a new home than go through the process of fixing up the one they have. According to the 2020 Profile of Home Buyers and Sellers report from the National Association of Realtors (NAR), 44% of homebuyers purchased a new home to “avoid renovations or problems with the plumbing or electricity.”

Depending on what needs to be addressed, today’s high buyer demand may make it possible to skip some renovations before selling. Many of these homeowners have prioritized buying over renovating for convenience and potential cost savings.

Bottom Line

It’s clear that homeownership needs are changing. As a result, Americans are expected to move in record numbers this year. If you’re trying to decide if now is the right time to buy a home, contact a local real estate professional today to discuss your options.

Why It’s Important To Have Preapproval

You may have heard that pre-approval is a great first step in the homebuying process. But why is it so important? When looking for a home, the temptation to fall in love with a house that’s outside your budget is very real. So, before you start shopping around, it’s helpful to know your price range, what you’re comfortable within a monthly mortgage payment, and ultimately how much money you can borrow for your loan. Pre-approval from a lender is the only way to do this.

According to a recent survey from realtor.com, many buyers are making the mistake of skipping the pre-approval step in the homebuying process:

“Of over 2,000 active home shoppers who plan to purchase a home in the next 12 months, only 52% obtained a pre-approval letter before beginning their home search, which means nearly half of home buyers are missing this crucial piece of paperwork.”

This paperwork (the pre-approval letter) shows sellers you’re a qualified buyer, something that can really help you stand out from the crowd in the current ultra-competitive market.

How competitive is today’s market? Extremely – especially among buyers.

With limited inventory, there are many more buyers than sellers right now, and that’s fueling the competition. According to the National Association of Realtors (NAR), homes are receiving an average of 2.9 offers for sellers to negotiate, so bidding wars are heating up.

Pre-approval shows homeowners you’re a serious buyer. It helps you stand out from the crowd if you get into a multiple-offer scenario, and these days, it’s likely. When a seller knows you’re qualified to buy the home, you’re in a better position to potentially win the bidding war and land the home of your dreams.

Danielle Hale, Chief Economist for realtor.com notes:

“For ‘a buyer in a competitive market, it’s typically essential to have pre-approval done in order to submit an offer, so getting it done before you even look at homes is a smart move that will enable a buyer to move fast to put an offer in on the right home.’”

In addition, today’s housing market is also changing from moment to moment. Interest rates are low, prices are going up, and lending institutions are regularly updating their standards. You’re going to need guidance to navigate these waters, so it’s important to have a team of professionals (a loan officer and a real estate agent) making sure you take the right steps along the way and can show your qualifications as a buyer at the time you find a home to purchase.

Bottom Line

In a competitive market with low inventory, a pre-approval letter is a game-changing piece of the homebuying process. If you’re ready to buy this year, reach out to a local real estate professional (who can also connect you with a trusted lender) before you start searching for a home.

Do’s and Don’ts after Applying For a Mortgage

Once you’ve found the right home and applied for a mortgage, there are some key things to keep in mind before you close. You’re undoubtedly excited about the opportunity to decorate your new place, but before you make any large purchases, move your money around, or make any major life changes, consult your lender – someone who is qualified to tell you how your financial decisions may impact your home loan.

Below is a list of things you shouldn’t do after applying for a mortgage. They’re all important to know – or simply just good reminders – for the process.

1. Don’t Deposit Cash into Your Bank Accounts Before Speaking with Your Bank or Lender. Lenders need to source your money, and cash is not easily traceable. Before you deposit any amount of cash into your accounts, discuss the proper way to document your transactions with your loan officer.

2. Don’t Make Any Large Purchases Like a New Car or Furniture for Your New Home. New debt comes with new monthly obligations. New obligations create new qualifications. People with new debt have higher debt-to-income ratios. Higher ratios make for riskier loans, and then sometimes qualified borrowers no longer qualify.

3. Don’t Co-Sign Other Loans for Anyone. When you co-sign, you’re obligated. With that obligation comes higher ratios as well. Even if you promise you won’t be the one making the payments, your lender will have to count the payments against you.

4. Don’t Change Bank Accounts. Remember, lenders need to source and track your assets. That task is significantly easier when there’s consistency among your accounts. Before you transfer any money, speak with your loan officer.

5. Don’t Apply for New Credit. It doesn’t matter whether it’s a new credit card or a new car. When you have your credit report run by organizations in multiple financial channels (mortgage, credit card, auto, etc.), your FICO® score will be impacted. Lower credit scores can determine your interest rate and maybe even your eligibility for approval.

6. Don’t Close Any Credit Accounts. Many buyers believe having less available credit makes them less risky and more likely to be approved. Wrong. A major component of your score is your length and depth of credit history (as opposed to just your payment history) and your total usage of credit as a percentage of available credit. Closing accounts has a negative impact on both of those determinants of your score.

Bottom Line

Any blip in income, assets, or credit should be reviewed and executed in a way that ensures your home loan can still be approved. If your job or employment status has changed recently, share that with your lender as well. The best plan is to fully disclose and discuss your intentions with your loan officer before you do anything financial in nature.

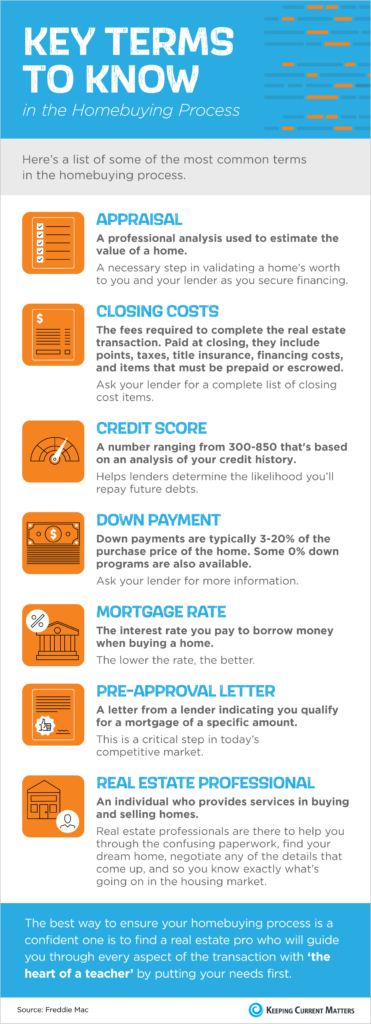

Terms to Know in Homebuying Process

Some Highlights

*Buying a home can be intimidating if you’re not familiar with the terms used throughout the process.

*To point you in the right direction, here’s a list of some of the most common language you’ll hear along the way.

*The best way to ensure your homebuying process is a positive one is to find a real estate professional who will guide you through every aspect of the transaction with ‘the heart of a teacher’ by putting your needs first.

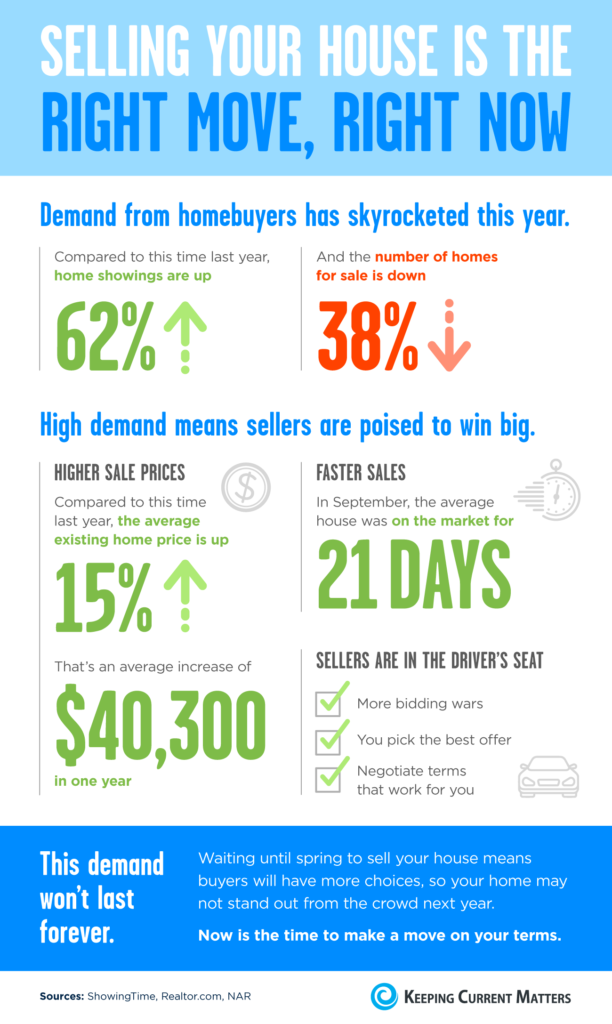

Selling Your House is The Right Move NOW

Some Highlights

Demand from homebuyers has skyrocketed this year, which means today’s sellers are poised to win big. This ideal moment in time to sell your house won’t last forever, though.

With more sellers coming to the market in the spring, waiting until next year means buyers will have more choices, so your home may not stand out from the crowd.

Reach out to a local real estate professional today to discuss why now may be the right time to make a move on your terms.

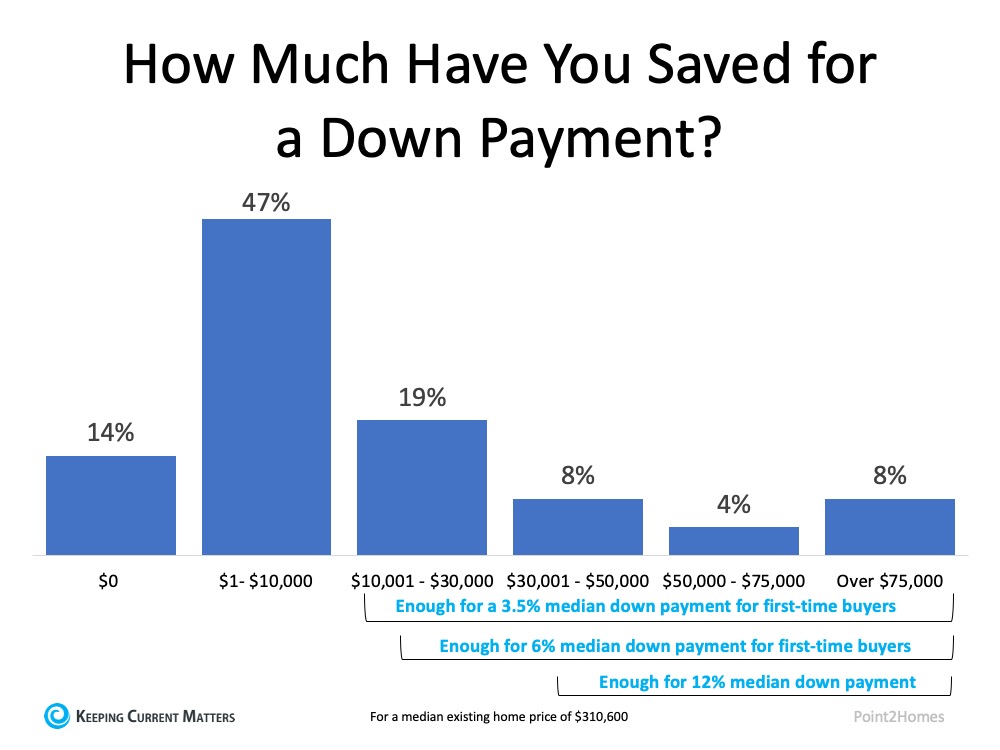

Do You Have Enough Money For A Down Payment?

One of the biggest misconceptions for first-time homebuyers is how much you’ll need to save for a down payment. Contrary to popular belief, you don’t always have to put 20% down to buy a house. Here’s how it breaks down.

A recent survey by Point2Homes mentions that 74% of millennials (ages 25-40) say they’re interested in purchasing a home over the next 12 months. The study notes, “88% say they have significantly less savings than the average national down payment amount, which is $62,600.”

Thankfully, $62,600 is not the amount every buyer needs for a down payment in the United States. There are many different options available, especially for first-time homebuyers (millennial or not). That amount can also be significantly less, depending on the purchase price of the house.

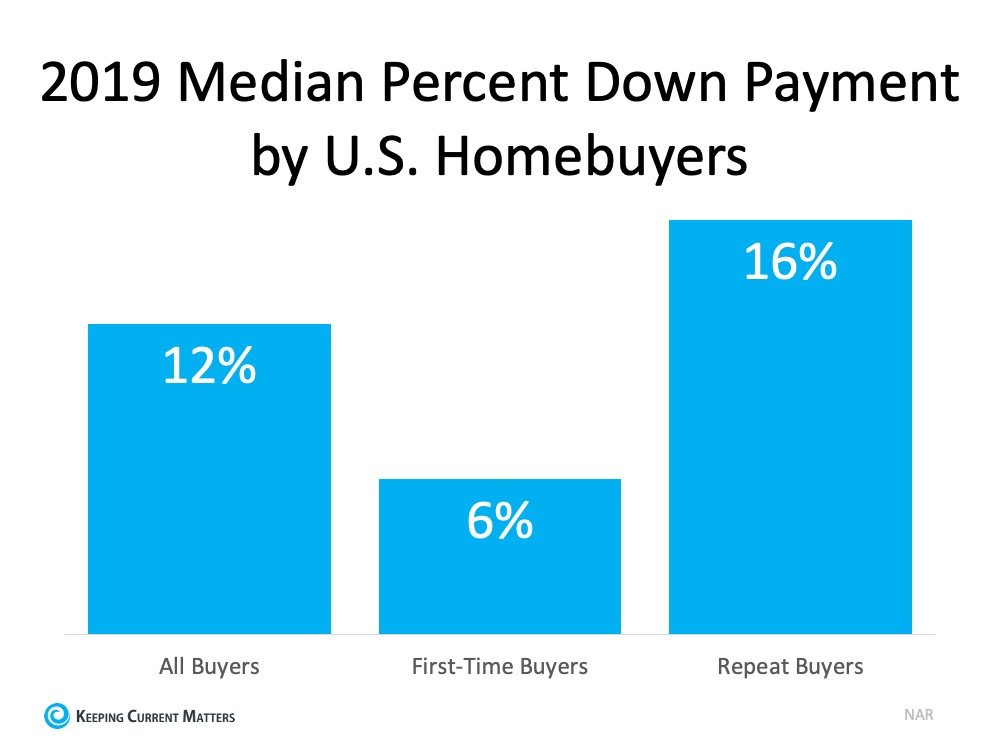

According to the National Association of Realtors (NAR), “The median existing-home price for all housing types in August was $310,600.” (These are the latest numbers available). NAR also indicates that:

“In 2019, the median down payment was 12 percent for all buyers, six percent for first-time buyers, and 16 percent for repeat buyers.” (See graph below):

That means if a qualified first-time buyer purchases a home at today’s median price, $310,600, with a 6% down payment, in reality, the down payment only amounts to $18,636. That’s nowhere near $62,600.

Knowing there are also programs like FHA where the down payment can be as low as 3.5% of the purchase price for a first-time buyer, that up-front cost could be significantly less – as little as $10,871 for the same home noted above. There are also other programs like USDA and loans for Veterans that waive down payment requirements.

The Point2Homes study also shares how much millennials have indicated they’ve saved for a down payment. As we can see in the graph below, 39% have already saved enough for a down payment on a median-priced home. Another 47% are close to reaching that goal, depending on the purchase price of the home.Unfortunately, the lack of knowledge about the homebuying process is keeping many motivated first-time buyers on the sidelines. That’s why it’s important to contact a local real estate professional to understand the requirements in your local area if you want to buy a home. A trusted agent and your lender can guide you through the process.

Bottom Line

Be careful not to let big myths about homebuying keep you and your family out of the housing market. Meet with a local real estate professional who can help you better understand and plan for your options today.

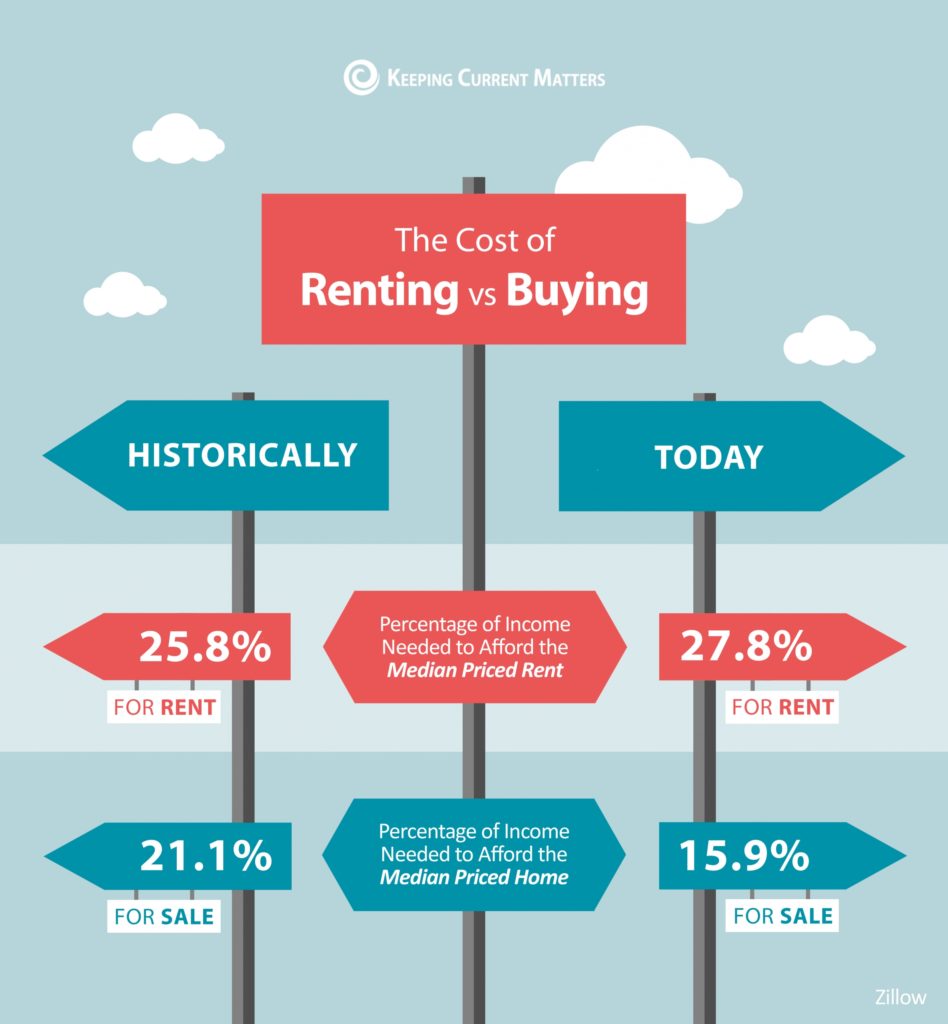

The Cost of Renting vs Buying

Some Highlights

- The percentage of income needed to afford a median-priced home today is declining, while that for renting is on the rise.

- This is making buying a home an increasingly attractive option for many people, especially with low mortgage rates driving purchasing power.

- If you’d like expert guidance on exploring your home buying options while affordability is high, reach out to a local real estate professional.

3 Ways to Win a Bidding War

With so few houses for sale today and low mortgage rates driving buyer activity, bidding wars are becoming more common. Multiple-offer scenarios are heating up, so it’s important to get pre-approved before you start your search. This way, you can put your best foot forward – quickly and efficiently – if you’re planning to buy a home this season.

Javier Vivas, Director of Economic Research at realtor.com, explains:

“COVID-19 has accelerated earlier trends, bringing even more buyers than the market can handle. In many markets, fierce competition, bidding wars, and multiple offer scenarios may be the common theme in the weeks to come.”

Here are three things you can do to make your offer a competitive one when you’re ready to make your move.

1. Be Ready

A recent survey shows that only 52% of active homebuyers obtained a pre-approval letter before they began their home search. That means about half of active buyers missed out on this key part of the process.

Buyers who are pre-approved are definitely a step ahead when it’s time to make an offer. Having a pre-approval letter indicating you’re a qualified buyer shows sellers you’re serious. It’s often a deciding factor that can tip the scale in your direction if there’s more than one offer on a home. It’s best to contact a mortgage professional to start your pre-approval process early, so you’re in the best position right from the start of your home search.

2. Present Your Best Offer

In a highly competitive market, it’s common for sellers to pick a date and time to review all offers on a house at one time. If this is the case, you may not have an opportunity to negotiate back and forth with the sellers. As a matter of fact, the National Association of Realtors (NAR) notes:

“Not only are properties selling quickly, but they are also getting more offers. On average, REALTORS® reported nearly three offers per sold property in July 2020.”

Make sure the offer you’re presenting is the best one the sellers receive. A real estate professional can help you make sure your offer is a fair and highly competitive one.

3. Act Fast

With existing homes going like hotcakes, there’s no time to waste in the process. NAR reports how the speed of home sales is ramping up:

“Properties typically remained on the market for 22 days in July, seasonally down from 24 days in June and from 29 days in July 2019. Sixty-eight percent of homes sold in July 2020 were on the market for less than a month.”

In addition, NAR notes:

“Total existing-home sales…jumped 24.7% from June to a seasonally adjusted annual rate of 5.86 million in July. The previous record monthly increase in sales was 20.7% in June of this year. Sales as a whole rose year-over-year, up 8.7% from a year ago (5.39 million in July 2019).”

As you can see, the market is gaining steam. For two consecutive months houses have sold very quickly. Essentially, you may not have time to sleep on it or shop around when you find a home you love. Chances are, someone else loves it too. If you take your time, it may not be available when you’re ready to commit.

Bottom Line

The housing market is very strong right now, and buyers are scooping up available homes faster than they’re coming to market. If you’re planning to purchase a home this year, talk to a local real estate professional to learn more about your current area, so you’re ready to compete – and win.

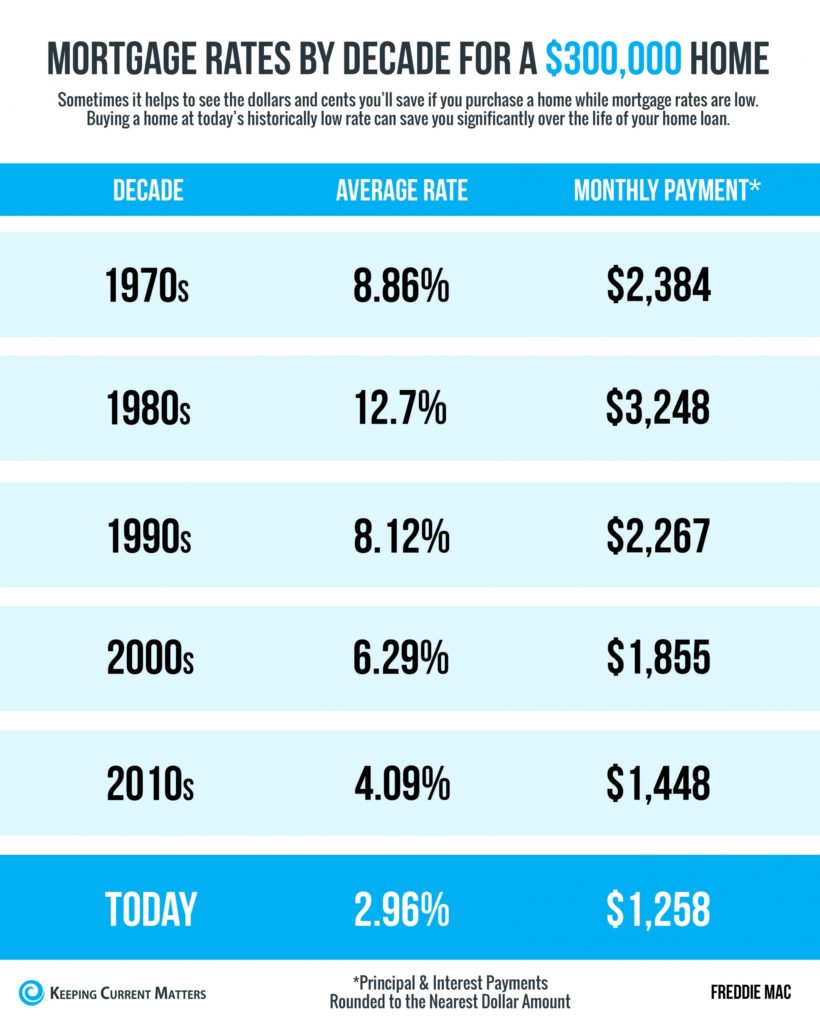

Mortgage Rates & Payments by the Decade

Sometimes it helps to see the dollars and cents you’ll save when you purchase a home while mortgage rates are low.

Today’s low rates mean it’s less expensive to borrow money, so the savings over the life of your loan is significant.

Reach out to a real estate professional to determine the best way to position your family for a financially-savvy move in today’s market.